In the third quarter of 2023, major shipping lines have reported substantial year-over-year (Y/Y) revenue declines, with the smallest contraction being at -51.8 per cent.

According to the latest analysis from Sea-Intelligence, data needs to be contextualised within the backdrop of a period marked by high rates. To mitigate the impact of this fluctuation, the firm opted to assess the third quarter of 2023 on an annualised basis in comparison to 2019.

This analysis revealed that the contraction observed in the examined period is a result of the exceptional growth experienced in 2021-2022. Consequently, the revenues are currently decreasing to levels consistent with the pre-pandemic period.

READ: Capacity growth for 2023 remains excessive

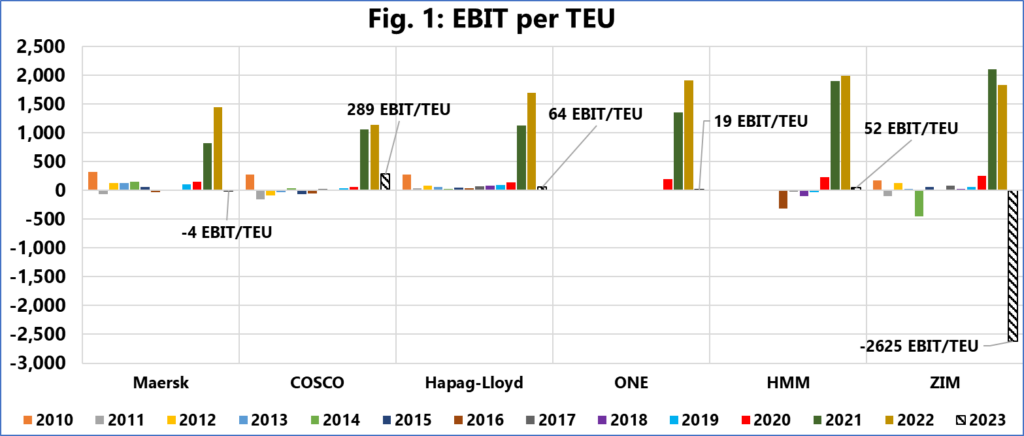

Following the exceptional highs of 2021-2022, Q3 2023 witnessed a drop in EBIT/TEU, aligning with pre-pandemic years.

Noteworthy performers in Sea-intelligence’s analysis include COSCO, leading with the highest EBIT/TEU at 289 USD/TEU, trailed by Hapag-Lloyd at 64 USD/TEU, and HMM at 52 USD/TEU.

Maersk reported the smallest negative EBIT/TEU at -4 USD/TEU, while ZIM recorded a significant negative EBIT/TEU of -2,625 USD/TEU, accompanied by an EBIT loss of $2.28 billion. ZIM, however, clarified that a substantial portion of this loss is attributed to a “non-cash impairment loss of USD 2.06 billion”.

In one of Sea-Intelligence’s latest report, the firm analysed that there has been a significant growth in the demand for recreational goods and services in the maritime industry.