According to Sea-Intelligence, capacity growth between Asia-North America has excessively increased following the COVID-19 pandemic.

In week 42, Sea-Intelligence examined the post-Golden Week capacity deployment on the Transpacific and Asia-Europe trades and discovered significant overcapacity on both routes.

In the absence of significant demand growth, Sea-Intelligence anticipated that carriers would announce a slew of blank sailings to offset this supply-side expansion.

Four weeks later, Sea-Intelligence has seen no new blank sailings announced, and capacity growth for the duration of 2023 remains rather high.

READ: Rising capacity concerns amid peak season

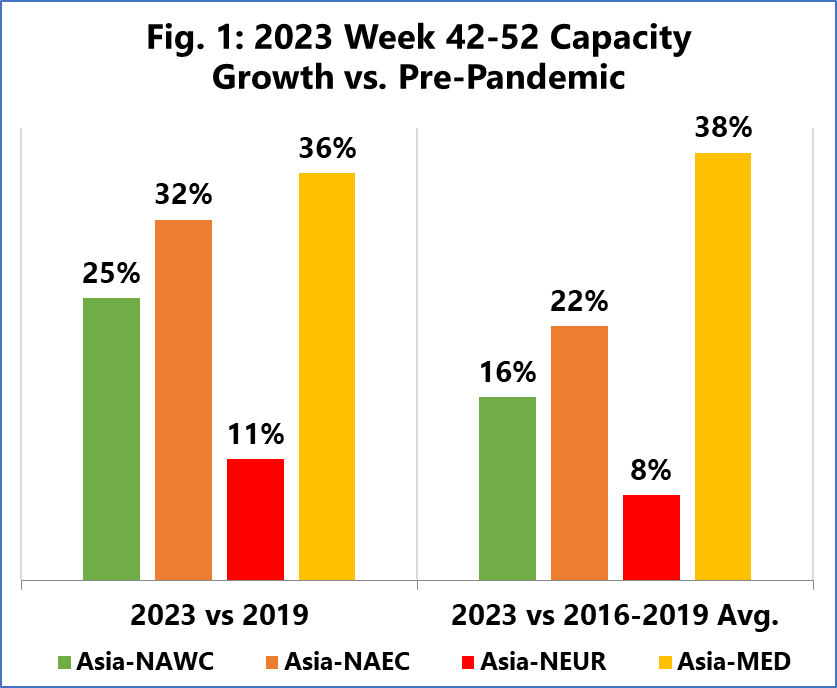

Figure 1 summarises these growth figures based on the most recent vessel deployments (Week 46, 2023).

These figures presented by Sea-Intelligence are for the last 10 weeks of 2023 (weeks 42-52) and are net of growth in 2019, as well as average growth from 2016 to 2019.

This means that Figure 1 does not reflect real growth, but rather how much greater it is relative to pre-pandemic years.

If capacity growth post-Golden Week 2023 is compared to the same time in 2019, or to the average growth of 2016-2019, Asia-North America West Coast is up 16 per cent – 25 per cent, Asia-North America East Coast is up 22 per cent – 32 per cent, Asia-North Europe is up 8 per cent – 11 per cent, and Asia-Mediterranean is up 36 per cent – 38 per cent. All of these figures point to unsustainable capacity increase.

READ: Vessel utilisation continues to decline

Alan Murphy, CEO of Sea-Intelligence, said: “With six weeks to go to the end of 2023, there are pretty much two ways in which this plays out.

“Either the carriers announce a massive blank sailings programme between now and the end of the year, which will reduce capacity, but will not go down well with the shippers as it will leave them scrambling to manage these sudden supply-side disruptions.

“Or the carriers ride this wave of high capacity injection and the likely downwards pressure on freight rates into the new year, and compensate for it during Chinese New Year.”

In October, Sea-Intelligence reported that the earliest recovery to the supply/demand equilibrium will begin in 2028.