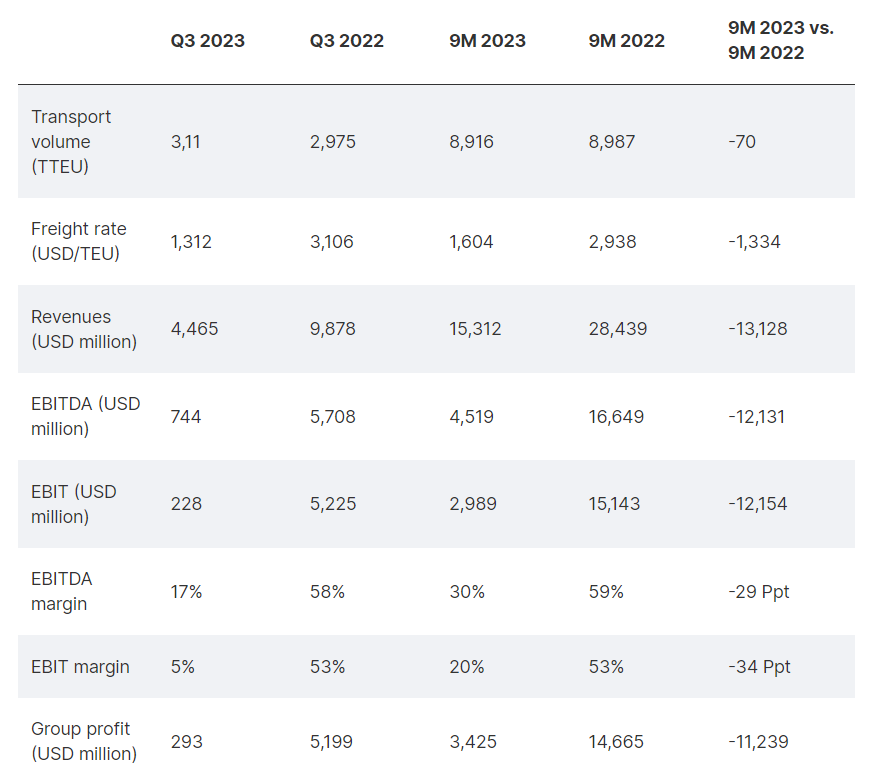

Hapag-Lloyd has reported a Group EBITDA of €4.2 billion ($4.5 billion) and a Group EBIT of €2.8 billion ($3 billion) for the first nine months (9M) of 2023.

The Group profit was €3.2 billion ($3.4 billion). Due to the dramatic change in market conditions, these results are much lower than the prior-year level.

With the expansion of its terminal operations, the Hapag-Lloyd Group’s commercial activities have been divided for the first time into Liner Shipping and Terminal & Infrastructure sectors.

The EBITDA in the Liner Shipping business fell to €4.1 billion ($4.5 billion) in the first nine months of 2023. The EBIT declined to $3.0 billion (€2.7 billion). Revenues fell to $14.1 billion ($15.2 billion), owing mostly to a reduced average freight rate of $1,604/TEU (9M 2022: $2,938/TEU).

This fell even further in Q3 2023, to $1,312/TEU (Q3 2022: $3,106/TTEU), and was much lower in some trades as compared to the same time the previous year.

READ: Hapag-Lloyd’s data conveys 29 per cent rise in cost inflation

Transport volumes, on the other hand, increased somewhat in the third quarter, rising by little under 5 per cent to 3,110 TEU (Q3 2022: 2,975 TTEU).

As a result, the total volumes of 8,916 TTEU in the first nine months of the year were nearly identical to those of the previous year (9 million 2022: 8,987 TTEU).

Transport expenditures fell 11 per cent year-on-year (YoY) to €8.9 billion ($9.6 billion), attributable mostly to the continuous normalisation of global supply chains and a reduced average bunker consumption price of $611 per tonne (9 million 2022: $755/tonne).

In the first nine months of 2023, the Terminal & Infrastructure division generated an EBITDA of €35 million ($38 million) and an EBIT of €27 million ($29 million).

READ: Hapag-Lloyd, Norsul establish cabotage business in Brazil

Rolf Habben Jansen, CEO of Hapag-Lloyd AG, said: “Thanks to an increase in transport volumes in the third quarter, volumes are roughly flat for the nine-month period compared to 2022. At the same time, we have continued to implement our strategic agenda, expanded our terminal portfolio, and boosted customer satisfaction again through quality improvements.

“However, freight rates are below the prior-year level and, as expected, fell again in the third quarter – which is reflected in much lower earnings.

“In response, we are working hard to reduce our expenses even more, such as by achieving savings on the procurement side and making adjustments to our service network. Nevertheless, if spot rates do not recover, we could face some challenging quarters in this subdued market environment.”