The demand figures for June 2023, released by Container Trade Statistics (CTS), mark the fourth consecutive month indicating a cessation in the global decline of demand growth.

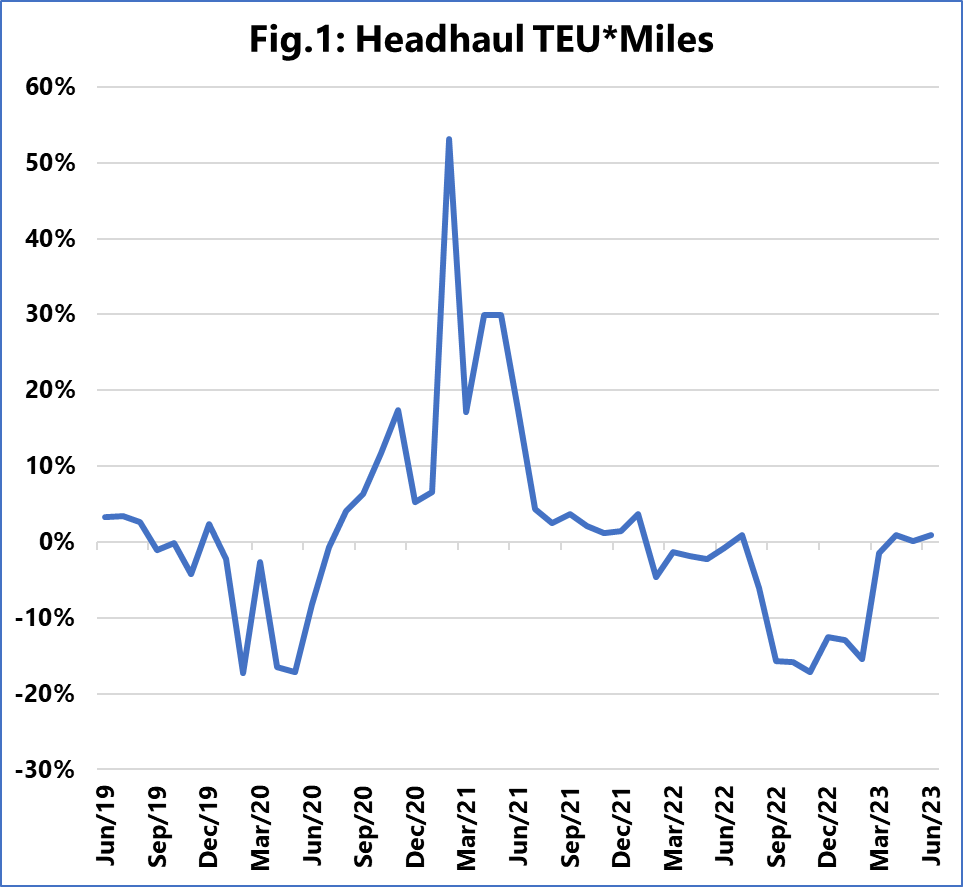

The latest analysis from Sea-intelligence factors in the distances covered to assess demand using TEU*Miles.

“Even though the demand collapse in TEU*Miles halted in February 2023, it cannot be said to have rebounded, as the growth rate is essentially hovering around zero,” said Alan Murphy, CEO of Sea-Intelligence.

Murphy followed that “it could be questioned whether there was a genuine collapse in demand or whether it was simply an artifact of a skewed year-on-year calculation.”

Sea-Intelligence argues that one might raise doubts about whether there truly was a demand collapse or if it was merely a result of an imbalanced year-on-year calculation.

Nevertheless, even when the comparison is on an annualised basis with 2019 (the last year before the pandemic), practically identical outcomes can be observed.

From the carriers’ financial standpoint, the demand growth in the head-haul trades stands out as the pivotal factor in global demand expansion, added Murphy.

The increase in global head-haul demand can be seen in figure 1. Once more, Sea-Intelligence notes how evident it is that the decline in demand has come to a halt. While it remains at a relatively low level, there have been three consecutive months of positive year-on-year demand growth.

“But, as we have also seen in previous months’ issues of the Sunday Spotlight, the global development is certainly not uniform across different deep-sea trades,” said Murphy.

READ: Transpacific blank sailings increase

In Europe, imports are recovering, but exports are still decreasing. This results in a deteriorating trade balance, leading to lower utilisation for exports and putting pressure on freight rates.

In North America, Sea-intelligence noted that the decline in demand for imports seems to be slowing down, but exports are still negative. This suggests a better trade balance is on the horizon for North America, according to Murphy.

Last month in July, Sea-Intelligence released data that raised concerns regarding shipping operators’ ability to control capacity for the future.