Vado Gateway experiences significant RoRo growth

The Vado Gateway in northern Italy has witnessed a remarkable surge in vehicle import volumes, marking a staggering 284 per cent

The Vado Gateway in northern Italy has witnessed a remarkable surge in vehicle import volumes, marking a staggering 284 per cent

Hamburger Hafen und Logistik AG (HHLA) has acquired a majority share in Roland Spedition GmbH (Roland), a prominent player in hinterland

The Bureau International des Containers (BIC), Container Owners Association (COA), Institute of International Container Lessors (IICL), and World Shipping Council (WSC)

PSA BDP has announced the launch of its first office in Paranaque City, the Philippines, as part of its plan to

The Helen Delich Bentley Port of Baltimore has suspended ship traffic entering and departing the port following the collision of the

During the month of February, goods passing through the San Pedro Bay Port Complex and destined for local distribution by truck

Mitsui O.S.K. Lines, Ltd. (MOL) has signed a Memorandum of Understanding (MoU) for the cooperative development of a synthetic fuel (e-fuel)

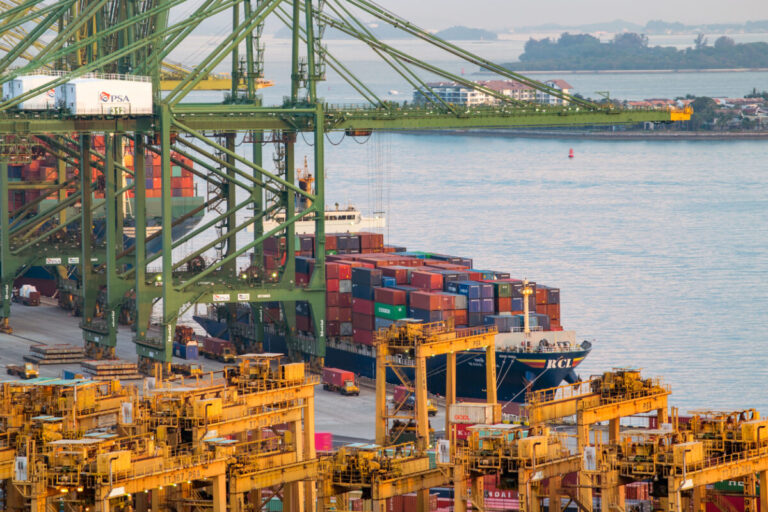

PSA Singapore (PSA) has announced a planned expansion of its Jurong Island Terminal (JIT) to satisfy increasing demand for sustainable, efficient,

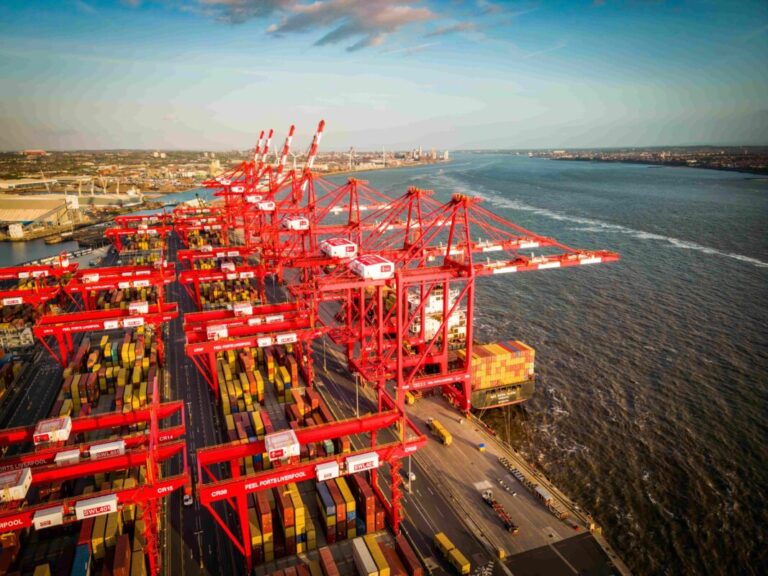

Some of the UK’s fastest-growing value retailers have joined major port operator Peel Ports Group in calling for a new UK

The shipping disruptions in the Red Sea and Suez Canal have had a significant impact on African port operations, according to

A.P. Moller – Maersk (Maersk) has set up a distribution hub in Mexico City to address the supply chain and logistical

Goods passing through the San Pedro Bay Port complex and bound for local distribution by truck spent an average of 2.89