Worldwide schedule reliability increased by 19.5 percentage points (PP) from 42.6 per cent to 62.1 per cent by 2023, found Sea-Intelligence.

The firm noted that despite the significant improvement, it barely reached the level of 2020 and remains behind the 70 per cent – 80 per cent of 2012-2019.

Schedule reliability has dropped month-over-month (MoM) during the fourth quarter, and Sea-Intelligence expects a similar impact in January 2024 as a result of the Red Sea crisis.

The Danish analysis firm believes that this will be temporary; once the extra transit time is factored into the carriers’ calculations, schedule reliability may improve.

Sea-Intelligence further stated that the crisis occurred too late to have a substantial influence on average delay, which improved from 6.38 to 4.83 days in 2023-FY.

READ: Red Sea crisis sparks second-largest capacity drop since Ever Given

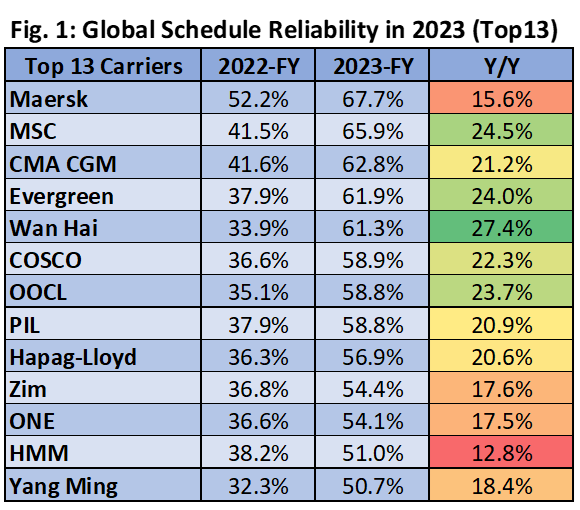

In terms of the global carriers, Maersk was the most reliable in 2023-FY with schedule reliability of 67.7 per cent, followed by MSC (65.9 per cent), CMA CGM (62.8 per cent), Evergreen (61.9 per cent), and Wan Hai (61.3 per cent) as the only carriers above 60 per cent.

In 2023-FY, the remaining carriers exhibited schedule reliability ranging from 50 to 60 per cent, with Yang Ming ranking last at 50.7 per cent.

All 13 global carriers reported double-digit year-on-year (YoY) growth, with Wan Hai posting the biggest increase of 27.4 PP.

READ: Sharp surge in shipping emissions predicted amid Red Sea crisis

The 2M alliance between Maersk and MSC, set to end in 2025, was the most trustworthy of the alliances, with 57.8 per cent, followed by the Ocean Alliance (55.3 per cent) and THE Alliance (43.1 per cent).

READ: Maersk, Hapag-Lloyd enter new shipping alliance

While all of them improved by double digits YoY, only 2M outperformed the industry average in the six key East/West transactions.

In 2023-FY, all six trade lanes improved their schedule reliability YoY, but only the Asia-Mediterranean trade lane outperformed the industry average.