The ongoing Red Sea crisis has plunged service networks into uncertainty, resulting in the second-largest capacity drop since the Suez Canal blockage.

Sea-Intelligence, a leading maritime analysis firm, has offered valuable insights through its “Trade Capacity Outlook” report, which compares current developments to normal volatility and market disruptions from previous years.

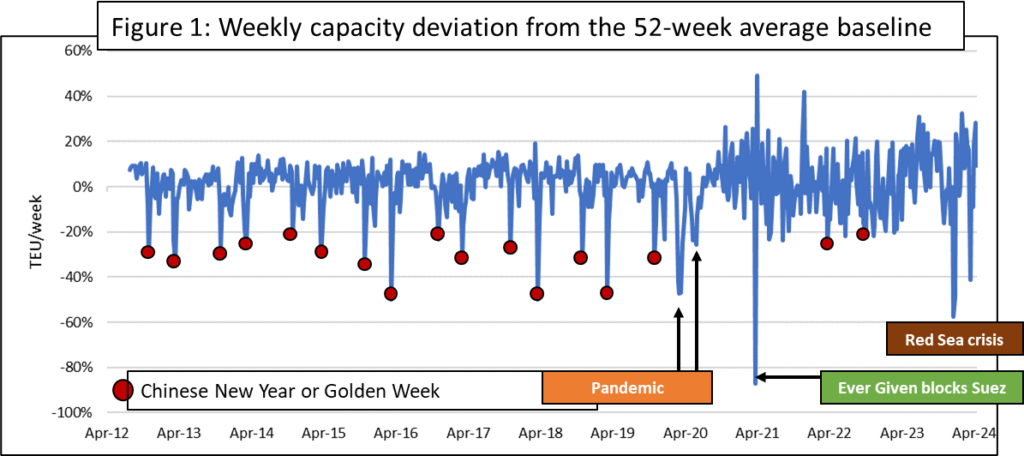

In the graph below, the firm highlighted that the red circles all represent Chinese New Year/Golden Week, when capacity cutbacks are catered to demand deficits caused by these vacations, and hence are seen as regular market conduct.

Green arrows indicate the pandemic’s two phases: the first, in which it only affected Chinese ports, and the second, in which it expanded globally.

READ: Red Sea crisis causes short-term capacity impact

A notable event that left an indelible mark on maritime history was the grounding of the Ever Given – for which Maersk just reached a settlement agreement for compensation over the six-day blockage in 2021.

This incident, marked on the graph, had the largest single impact on service networks according to Sea-Intelligence’s analysis.

“It should be noted, though, that part of this ended up overlapping with capacity changes related to Chinese New Year that year,” clarified Alan Murphy, CEO of Sea-Intelligence.

Finally, the firm identified and highlighted the Red Sea Crisis as the most substantial single event, surpassing even the early impacts of the pandemic, with the Ever Given being the only exception.

READ: Red Sea hostility triggers spark in shipping insurance

Recently, Mike DeAngelis, Head of International Solutions at FourKites, contributed insights on the recent Red Sea attacks and their far-reaching impact on the global shipping industry.