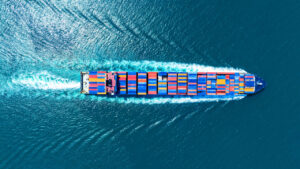

Insurance for vessels voyaging across the Red Sea has spiked amidst the increased threat from attacks by Houthi forces in Yemen, Bloomberg reported.

Already labelled by the US Navy as a danger zone for merchant shipping, the insurance impediment further exacerbates issues for trade through the key waterway.

Since the US and UK’s concerted airstrikes targeting Houthi forces at the end of last week, underwriters have increased their fees, charging between 0.75 per cent and 1 per cent of the value of the ship to voyage across the region, reported Bloomberg. Quotes for cover were a mere tenth of this amount only a few weeks prior.

A 1 per cent war insurance cost for a $100 million worth newbuild ship would equal $1 million in fees to cross the Red Sea and the Gulf of Aden.

The insurance jump serves as a financial deterrent for shippers who are already having to deal with the transit fee for the Suez Canal.

Shipowners and charterers are thus beginning to consider alternative routes, particularly around the Cape of Good Hope. However, such longer voyages will unavoidably lead to shippers spending more on fuel and releasing more emissions.

Clarksons Securities analysts including Frode Morkedal said in a report: “War risk insurance premiums for ships have skyrocketed.

“Shipowners and charterers may find that rerouting around Africa is more cost-effective than incurring the combined costs of Suez Canal transit fees and insurance premiums.”

READ: Red Sea crisis stifles global shipping

The danger of navigating through the Gulf of Aden remains persistent as a missile struck a US-flagged commercial ship on 15 January. The US Department of Transportation subsequently issued an updated alert warning merchant vessels to avoid the Southern Red Sea, as per Bloomberg’s report.

“Rates are increasing which is reflective of the significant and opaque risk exposure within the Red Sea,” said Munro Anderson, Head of Operations at marine war risk and insurance specialist, Vessel Protect.

“The key difficulty presented by the current situation is the rate of change in risk profile leading to far more dynamic pricing than would normally be the case.”