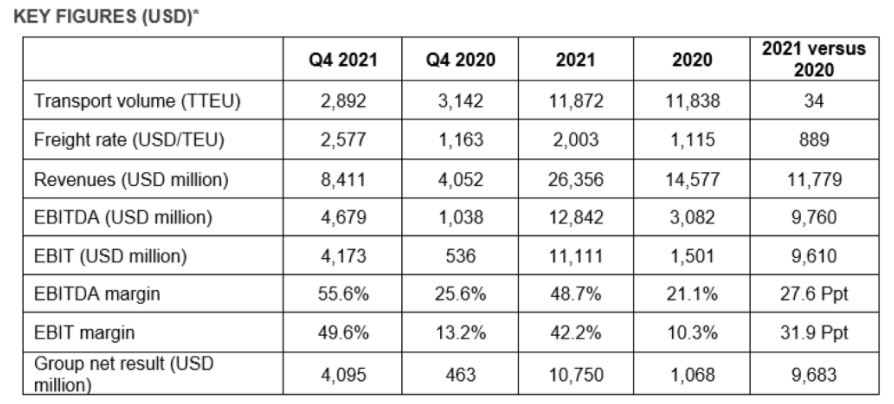

Hapag-Lloyd has published its audited annual report for the 2021 financial year, reporting revenues of $26.4 billion.

The shipping line published its “extraordinarily strong” preliminary figures for its 2021 operating results last month.

As expected, the group’s EBITDA increased to slightly more than $12.8 billion, while EBIT rose to $11.1 billion.

Furthermore, the group’s net result improved to around $10.8 billion.

These positive results were mainly driven by high freight rates, introduced due to very strong demand for goods exported from Asia.

“We look back on an exceptionally successful year in which we invested massively in modern vessels and new containers. In addition, we have significantly strengthened our financial and asset position. However, transport expenses have unfortunately also risen significantly, mainly due to the bottlenecks in the global supply chains,” said Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

Transport volumes were roughly on par with 2020, at 11.9 million TEU, this was due to the continued strain on supply chains.

Transport expenses rose significantly, by 17.1 per cent, to $12.2 billion. This was partially caused by higher bunker prices and charter rates as well as increased demurrage and storage fees.

Looking forward, Hapag-Lloyd expects this trend of very strong earnings to continue into the first half of 2022. For the second half, it anticipates that the strain on global supply chains will begin to ease, leading to a normalisation of earnings.

For the next year, EBITDA is predicted to be in the range of $12 billion to $14 billion and EBIT between $10 billion and $12 billion. However, this remains subject to considerable uncertainty due to the COVID-19 pandemic and the recent Russian invasion of Ukraine.

“The 2022 financial year has gotten off to a successful start for us, but the disruptions in the supply chains have not eased materially yet,” Jansen added.

“In addition to that, we all face the terrible war in Ukraine. We stand united with the international community, have stopped our bookings to and from Russia, and call for de-escalation and peace.

“The safety and well-being of all of our employees continues to be our top priority – and we will also do whatever we can to provide humanitarian support.”

Some of the group’s operational highlights from the last year include it finalising its acquisition of Dutch container shipping company Nile Dutch Investment B.V. (NileDutch).

The acquisition aims to strengthen Hapag-Lloyd’s position in West Africa and unlock the enormous potential that Africa offers for growing together with customers, the carrier said.

In September, it also announced it was to acquire a 30 per cent stake in Container Terminal Wilhelmshaven at JadeWeserPort in Germany.

The remaining shares continue to be owned by Bremen terminal operator Eurogate.

The German shipping line also completed its integration onto the TradeLens platform in June, helping ensure a more timely and consistent view of logistics data for its containerised freight around the world.