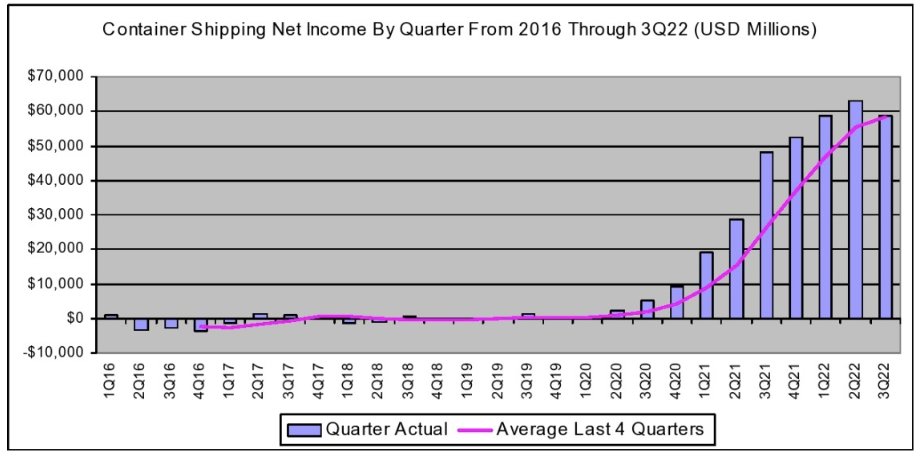

The box shipping sector had a $58.9 billion net income for the third quarter of the year.

The figure is an increase of $10.8 billion and 22.4 per cent from the $48.1 billion profit for 3Q2021.

The stats come from John McCown’s Blue Alpha Capital quarterly profits report, an industry-leading container outlook portfolio.

Compared sequentially to 2Q2022, net income was $4.1 billion or 6.6 per cent lower.

The small downturn follows seven straight quarters of record net income for the sector driven by pricing increases across most container lanes.

READ: CMA CGM warns of uncertain waters in bleak outlook

McCown noted that 2Q2022 will be recognised as the peak in terms of earnings echoing global sentiments that the record-breaking profit run for carriers is slowing down.

“The sharp upturn in the quarterly bottom line performance of the container industry over the last two years is one of the most pronounced performance changes ever by an overall industry,” McCown wrote.

“It comes on the heels of results in the more than 10 years following the financial crisis and preceding the pandemic that resulted in a negative overall bottom line. The container shipping industry has literally gone from being at the bottom related to overall industry performance to being at the top,” McCown added.

In individual comparisons to last year, eight of the 11 companies showed more net income for the quarter with all 11 companies showing more pronounced improvements in comparing the trailing 12-month periods.

READ: ONE posts $11 billion profit – but declining demand hits income forecast

McCown detailed that the sky-high profits for carriers have resulted in “unprecedented” new vessel orders, with the total order book now at a record level of almost 30 per cent in terms of TEU capacity.

In his future outlook, conditions that gave rise to congestion – including supply/demand factors, workforce disputes, and COVID-19 lockdowns – have mostly gone away, McCown notes.

“As those conditions continue to dissipate, that effect will unwind and capacity will rebound. Given the exceptional financial results that have accompanied the imbalance in favour of the carriers, carriers will look for ways to mitigate the impact of this unwinding,” he wrote.

Blanking or cancelling sailings, which worked well at the beginning of the pandemic, could be utilised “much more to reduce capacity” going forward, McCown predicted.