In a recent interview, Glenn Koepke, General Manager of Network Collaboration at FourKites, provided insights into the possible ramifications of a strike affecting ports on the US East Coast.

From automotive parts and pharmaceuticals to apparel, computers, and industrial supplies, the East Coast plays a crucial role in the supply chain. Major metropolitan areas and ports like New York/New Jersey, Miami, Houston, and Baltimore further underscore the significance of this region.

“With 2024 still expected to be a relatively slow market, the chaos this would create is less than what it would have been if a strike were on the table a year ago,” explained Koepke.

“Shippers and BCOs will need to take into account the potential long lead times as they chart out their risk and supply chain network in 2024.”

In response to the potential threat, Koepke stressed the importance of proactive communication and collaboration among stakeholders, including suppliers, partners, and customers. Shippers should have robust and regularly tested continuity plans in place, along with systems for mass communication and process management.

To enhance preparedness, Koepke recommended mapping out the entire supply chain, identifying the source of raw materials, tracking the shipment of finished goods, and assessing exposure to potential disruptions.

“Supply chain visibility and management tools can help businesses evaluate their exposure by answering questions about how much critical product is coming via ocean and determine how they can adjust delivery schedules and routes should they need to leverage alternative shipping lanes or modes,” added Koepke.

READ: Top challenges in digitising supply chains

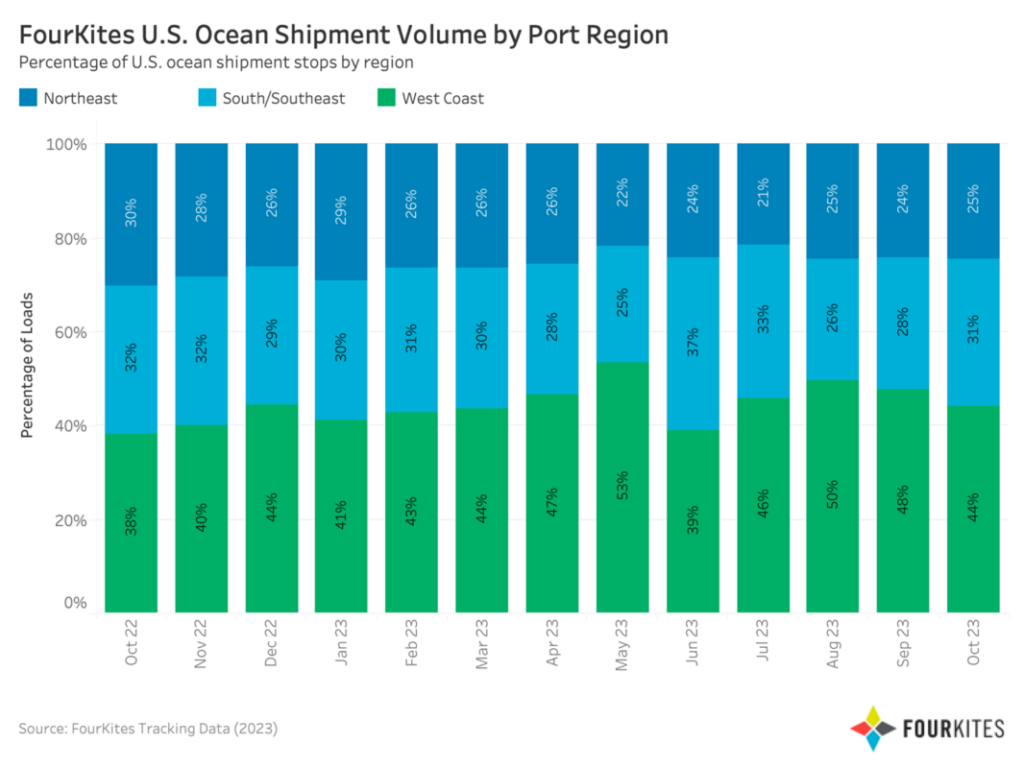

Addressing the question of what to expect if a strike becomes imminent, Koepke highlighted the recent trend of East Coast ports gaining import volume at the expense of West Coast ports due to efforts to avoid backlogs and delays. While the balance may shift back West over time, the threat of labour strikes could expedite this reversion to historical norms.

Koepke also pointed out that with the 2024 Presidential election looming, there is a likelihood of increased disruptions in the news, which may pose challenges for supply chain planning teams, CFOs, and risk management teams as they navigate the distinction between actual threats and mere noise.

This ratification represented the concluding phase of an extensive process initiated in May 2022. A tentative agreement was not reached until June 2023, causing uncertainty for shippers due to the looming threat of strike action and an uptick in cargo diversions to ports on the East and US Gulf Coasts.