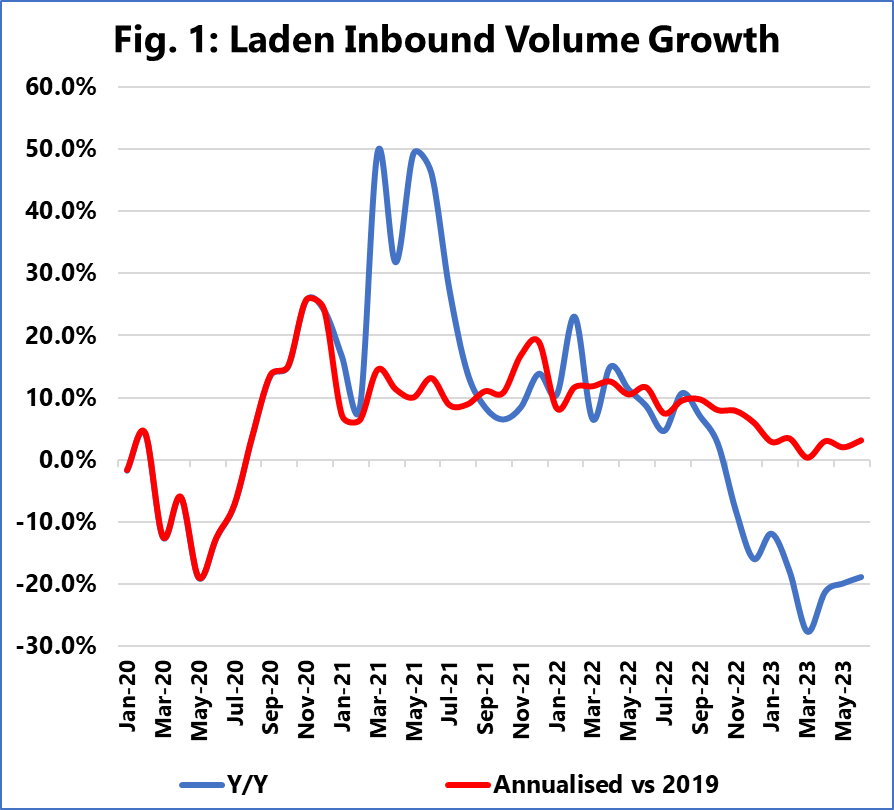

Annualised growth rate of loaded imports has recommenced compared to the pre-pandemic year 2019, with an average of 2.7 per cent during the second quarter of 2023.

The recently revealed Sea-Intelligence statistics have examined annualised growth instead of the traditional year-over-year (YoY) change. This approach is important to consider because analysing Y/Y growth during the pandemic era can be deceptive due to the comparison period experiencing exceptional levels of growth and volatility, reported the firm.

Sea Intelligence witnessed that annualised growth over 2019 had dropped from double-digits to 5.9 per cent by December 2022, and to a marginal growth of 0.3 per cent in March 2023.

READ: North America West Coast ports show signs of import normalisation

However, the annualised growth rate has ranged between 2.0 per cent and 3.1 per cent since then, with the latter being the most recent statistic from June 2023.

In contrast, North America West Coast loaded import volumes have been declining since September 2022, with the most recent data of June 2023 indicating a 0 per cent increase, i.e., no growth and no contraction.

Towards the end of 2022, and employing the same set of ports on both North American coast, Sea-Intelligence observed that the East Coast began to handle more volumes than the West Coast, with the ratio lowering to 0.89 in favour of the East Coast in December 2022.

However, by June 2023, the ratio had risen to 1.06, showing that West Coast ports were once again handling greater quantities than East Coast ports, but the ratio was still far from the pre-pandemic highs.

Two months later, the pace of shrinkage for both loaded imports and overall handled volumes has been slowly moderating in recent months, according to Sea-Intelligence research.