Sea-Intelligence has examined vessel deployment during round-Africa sailing amidst disruptions in the Red Sea to offer insights into cost mitigation and fuel consumption.

The company stated that the average size of ships on the Asia-North Europe route has stayed consistent, with minor fluctuations.

If a round-Africa route is chosen, the fuel consumption will increase, and as a result, there will be a rise in slot cost, assuming all other factors remain the same. Sea-Intelligence suggests that deploying larger and more fuel-efficient vessels could help reduce these higher slot costs if the vessels are well-utilised.

On the Asia-Mediterranean route, there is a clear upward trend, although it began in the second half of 2023, much before the first Houthi attack in the Red Sea. Additionally, on the same route, 2M and THE Alliance maintained a stable average vessel size.

In contrast, Ocean Alliance saw a sharp increase following the first attacks in the Red Sea, followed by a decline back to the early 2023 baseline, indicating that the changes were primarily caused by network disruptions rather than systemic.

READ: MSC adapts capacity on Asia-North Europe route

Sea-Intelligence suggests that looking only at average vessel size may be misleading due to outliers on either end of the spectrum.

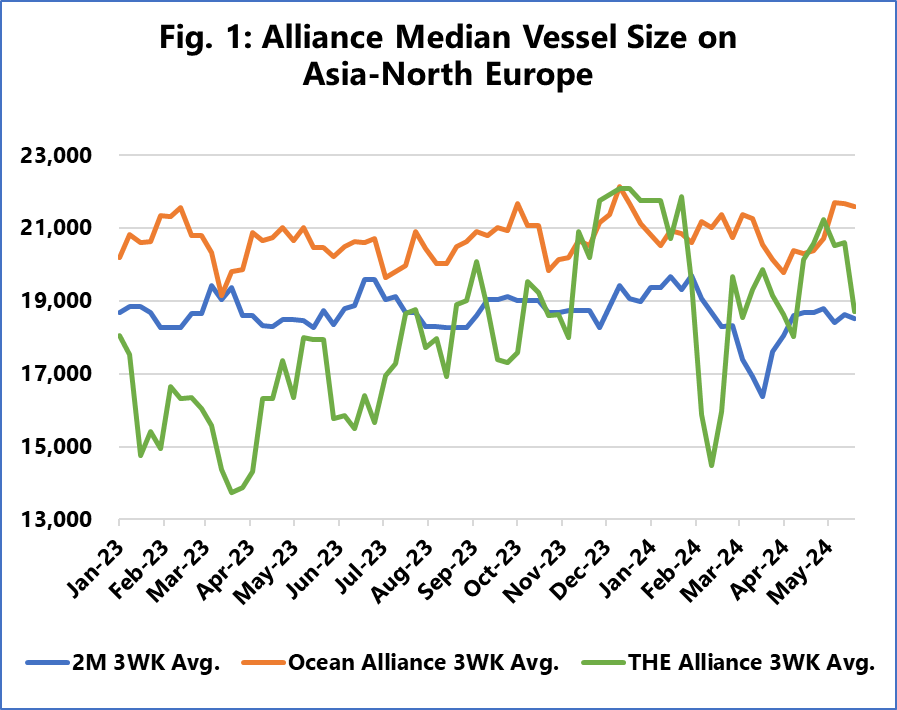

Looking at the median vessel size in Asia-North Europe, the median vessel size for 2M nearly completely matches the average vessel size.

For Ocean Alliance, Sea-Intelligence attributes the February 2024 dip in average vessel size to outliers, without which, the average vessel size remains stable.

For THE Alliance, there is a significant difference between the average and median vessel sizes, which coincides nearly precisely with the start of round-Africa sailings.

This was due to the suspension of the FE5, which had a smaller average vessel size.

According to Sea-Intelligence, this does not constitute a direct upscaling of deployed vessels to decrease average slot costs, but suspending the service still reaches this goal by removing vessels with a lower average slot cost, all else equal.