Rebecca Galanopoulos-Jones, Senior Content Analyst at Veson Nautical, reflects on Veson Nautical’s latest data report that indicates a notable shift in traffic patterns amidst the escalating conflict in Yemen and the Red Sea.

From security concerns, rerouting of containerships, to insurance premiums, the conflict has impacted global trade on multiple fronts in a region recognised for its great strategic importance while being home to several critical trade routes.

Compounding the matter further, Galanopoulos-Jones stresses how the precarious state of affairs in the Red Sea has implicated trade through the Suez Canal, thereby threatening mass financial losses in trade and transport for liners worldwide.

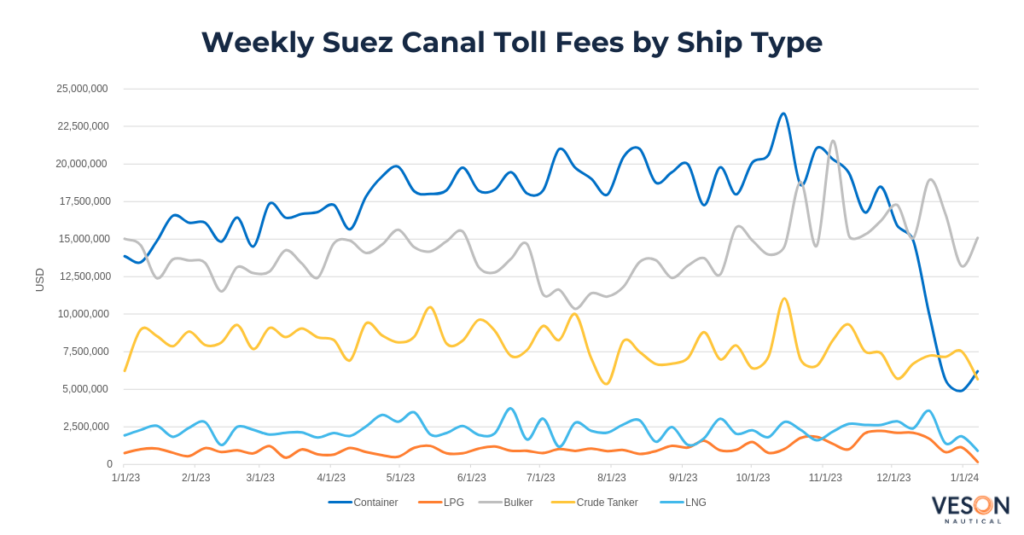

Veson Nautical looked at the fluctuating toll fees charged for crude tankers, bulkers, LNG, LPG and containers over the period from early 2023, to early 2024. Galanopoulos-Jones shared data that offers essential insights into the financial implications for the Suez Canal, and for the Egyptian government at large as Suez Canal transits drop to an all-time low.

Since late November 2023, tolls have plummeted 40 per cent from $47 million to $28 million. Container tolls, more notably, dropped by 66 per cent where estimated fees fell from $18 million in the last week of November to $6 million at the start of the new year. The LPG sector suffered the biggest percentage drop with tolls down by $93 per cent while bulkers were the least affected having only dropped 7 per cent.

For Galanopoulos-Jones, a lower income from toll fees is likely to persist. “However, understanding the economic repercussions on the nation could foster a more proactive approach to resolving the conflict and alleviate its adverse effects on global trade,” she commented.

READ: Xeneta forecasts rise in ocean freight rates amid Red Sea crisis

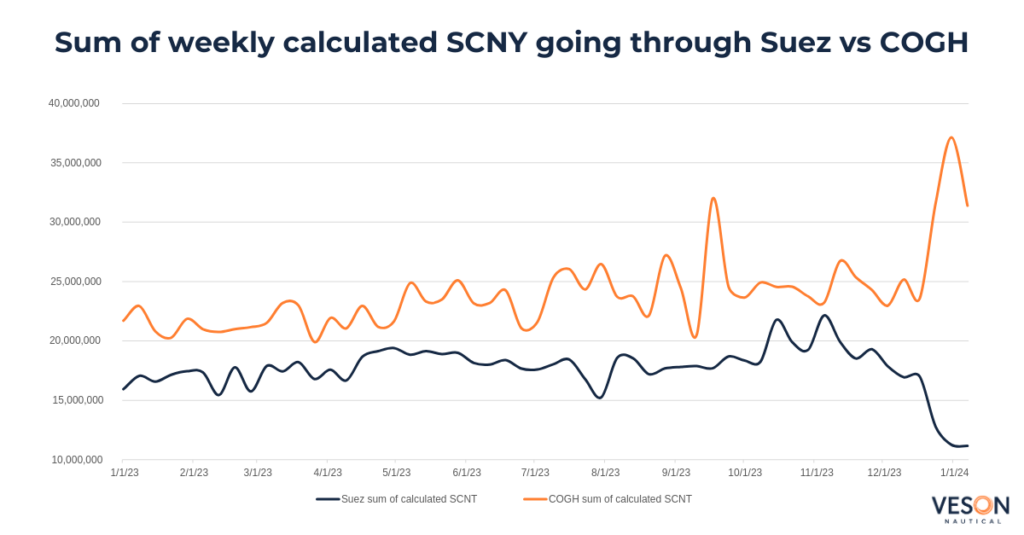

With regards to the impact such events have had on shipping lanes and vital trade routes, Galanopoulos-Jones points to the stark changes in traffic that become evident following the onset of the Red Sea hostility. Since November, a reduction in Suez Canal Net Tonnage (SCNT) through the Suez Canal can be seen to be directly corresponded by an increase in the Cape of Good Hope (COGH). Each month, the number of ships passing through the Suez Canal has dropped by roughly 38 per cent, while the number of ships taking the route around the Cape of Good Hope has increased by about 25 per cent.

READ: Major carriers adapt services in wake of Red Sea tension

Galanopoulos-Jones appeals to the uptick in targeted attacks on vessels that have forced liners to alter their routes until further notice. In addition to safety concerns, she stressed how the ongoing violence threatens rising oil prices, and shipment delays, alongside geopolitical stability at large. With the COGH route more than doubling the length of voyages from the Middle East to Europe, environmental considerations also come to the forefront. With no imminent resolution in sight, Galanopoulos-Jones warns that these concerns could worsen over time while triggering spikes in commodity prices and emissions.

In the container industry, the change in route has stopped the decline in freight rates that have been consistent since 2022. Ships that have chosen to go around the Cape of Good Hope instead of through the Red Sea have retrieved higher earnings, according to Galanopoulos-Jones, Post Panamax period rates for one year up by 7 per cent from December. Nonetheless, Galanopoulos-Jones asserted that despite the short-term increases in earnings, looking ahead, such financial opportunities may be offset by increased costs to the owner.

“As vessels divert away from the affected area and opt for the Cape of Good Hope route, tonne-mile demand for various sectors has increased, providing support to vessel earnings,” she said.

“In addition, the intervention of the US and UK military with strikes has caused a spike in oil prices. While levels have not risen as dramatically as they did following the invasion of Ukraine, there are ongoing threats of retaliation from Iranian-backed forces, suggesting potential further disruptions to oil supply in the future.”

This time last month, the Federal Maritime Commission (FMC) scheduled an informal public hearing to investigate how circumstances in the Red Sea and Gulf of Aden regions affect commercial shipping and global supply networks.