According to Sea-Intelligence, all shipping lines’ revenues fell sharply year-on-year (YoY) in 2023, ranging from 46.6 per cent to 62.6 per cent.

However, the annualised revenue growth rate in 2023-FY is consistent with 2018-2019, implying that the high YoY revenue decrease in 2023-FY is a result of the anomalous revenue growth of 2021-2022, rather than a fundamental revenue loss in 2023.

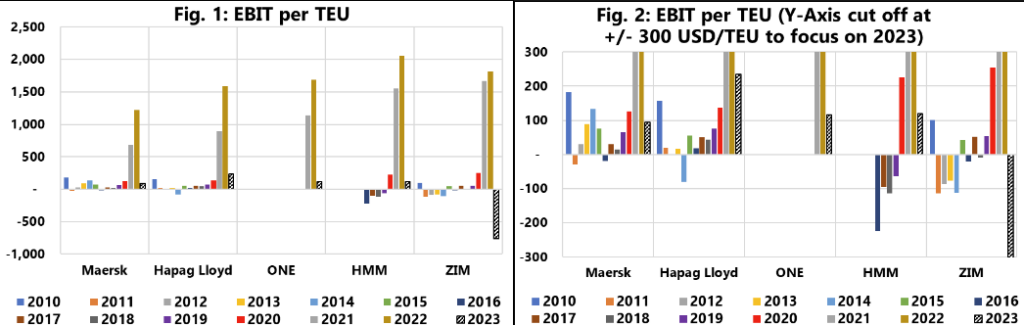

ZIM, Yang Ming and Wan Hai all reported EBIT losses in fiscal year 2023. While four shipping lines reported EBIT of more than $1 billion, Sea-Intelligence noted that it is apparent that profitability levels are nowhere near those in 2021-2022.

EBIT per TEU is one method for visualising profitability. Figure 1 depicts EBIT from 2010 to 2023, including the exceptional values during the 2021-2022 pandemic era, whereas Figure 2 cuts off the y-axis at +/- 300 USD/TEU to illustrate changes in 2023.

READ: Major carriers’ revenues plunge to pre-pandemic depths in Q3

Alan Murphy, CEO of Sea-Intelligence, pointed out that EBIT/TEU data is available for five shipping lines so far, with COSCO and OOCL yet to publish, and CMA CGM no longer publicly disclosing EBIT figures.

He noted that Maersk’s EBIT/TEU stands at 94 USD/TEU, notably lower than the figures for 2021-2022 but still surpassing most pre-pandemic years. In contrast, Hapag-Lloyd’s figure of 235 USD/TEU marks its highest outside of the 2021-2022 period.

READ: Hapag-Lloyd faces significant decline in earnings

Regarding ONE, there isn’t a pre-pandemic reference point available. However, HMM’s 2023-FY EBIT/TEU of 119 USD/TEU, although lower than in 2020, reflects an improvement throughout 2011-2019 when they faced consistent losses.

ZIM recorded an EBIT/TEU loss of -765 USD/TEU, attributed to a “non-cash impairment loss of $2.06 billion recorded in the third quarter.”