ZIM Integrated Shipping Services Ltd. (ZIM) has reported its consolidated results for the quarter and year ended 31 December 2023.

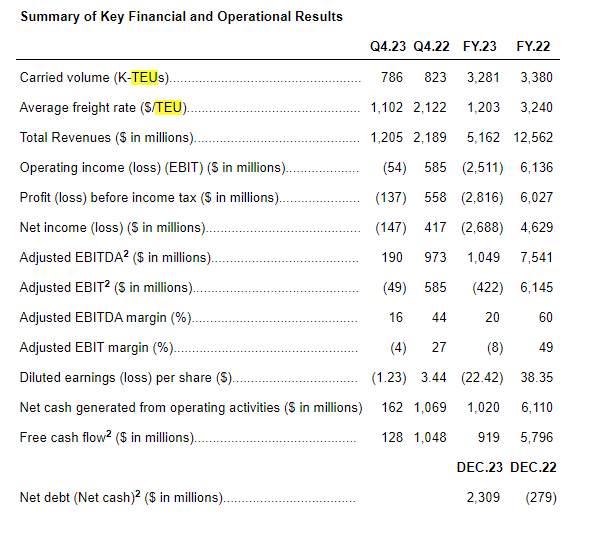

The company recorded a net loss of $147 million in the fourth quarter (compared to a net profit of $417 million in Q4 2022).

The net loss for the whole year, including a $2.06 billion non-cash impairment charge, was $2.69 billion (compared to a net profit of $4.63 billion in 2022).

Adjusted EBITDA for the fourth quarter was $190 million, a year-over-year (YoY) decrease of 80 per cent; Adjusted EBITDA for the full year was $1.05 billion, a YoY decrease of 86 per cent.

The operating loss (EBIT) for the fourth quarter was reportedly $54 million, compared to operating income of $585 million in Q4 2022.

READ: ZIM revises 2023 projection

ZIM’s operating loss for the whole year of 2023 was $2.51 billion (due to a non-cash impairment loss of $2.06 billion reported in the third quarter), compared to operating income of $6.14 billion for the same period in 2022.

The fourth quarter’s adjusted EBIT deficit was $49 million, compared to $585 million in Q4 2022. The adjusted EBIT loss for the full year 2023 was $422 million, compared to $6.15 billion for the full year 2022.

Revenues for the fourth quarter were $1.21 billion, a 45 per cent decline from the previous year; sales for the whole year were $5.16 billion, a 59 per cent decrease.

Carried volume in the fourth quarter was 786,000 TEU, a 4.6 per cent decline YoY, while carried volume in the entire year was 3.28 million TEU, a 2.9 per cent decrease.

READ: ZIM witnesses significant Q2 revenues downturn

In the fourth quarter, the average freight rate per TEU was $1,102, down 48 per cent from the previous year. For the entire year, the average freight rate per TEU was $1,203, down 63 per cent.

As of 31 December 2023, ZIM reported the net leverage ratio to be 2.2x, up from 0.0x in December 2022. The net debt was $2.3 billion, with a cash balance of $279 million in December 2022.

Eli Glickman, ZIM President and CEO, stated: “During a time when the market remains volatile, our strong cash position will enable us to continue to maintain a long-term view as we focus on generating sustainable value for both customers and shareholders.

“Looking ahead, we intend to continue to take decisive steps to further benefit from our strategic transformation and expect ZIM to emerge in a stronger position than ever in 2025 and beyond.”

In November 2023, ZIM announced its consolidated results for the three and nine months ended 30 September 2023.