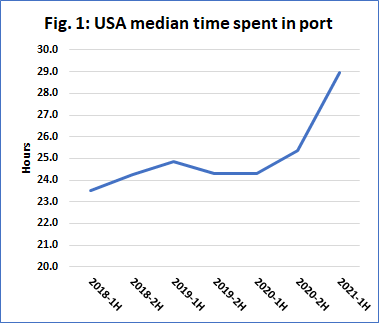

The median time spent by container vessels in port began to grow sharply in the second half of 2020, continuing into the first half of 2021.

In Issue 532 of the Sunday Spotlight, analysts Sea-Intelligence used data published by United Nations Conference on Trade and Development (UNCTAD) on port stays to shed light on the current bottleneck issues faced by the container shipping industry.

Calculations showed that the median time spent in port in first half of 2021 was higher by 11% compared to the pre-pandemic average time spent in port in 2018 and 2019.

Comparing this to the global demand data published by Container Trade Statistics (CTS) – which was up 5.5% over the same period – shows that the efficiency of the port calls themselves declined in 2021.

Compared to the other vessel types, the median time spent in port for container vessels recorded a far greater increase, Sea-Intelligence found.

Global average berth duration for Hapag-Lloyd’s fleet have increased a 11.4% from the first half of 2020 to 2021, CEO of the shipping line Rolf Habben Jansen said on 8 September.

“The container shipping sector is more impacted by the supply chain bottlenecks than other parts of shipping – which in all likelihood can be traced to the container shipping sector having a strong reliance on a land-side intermodal setup, which also suffers from severe bottlenecks presently,” Sea-Intelligence wrote.

Increased e-commerce demand, in addition to tight inland capacity, warehousing storage facilities, and labour availability have all been highlighted by experts as prime drivers behind the soaring numbers of vessels waiting to access ports.

In a bid to alleviate increasing vessel traffic, the ports of Long Beach and Los Angeles announced on 17 September that they will expand hours of container pick up availability for the chassis sector.

China recorded a 12% increase in the first half of 2021 vs 2018-2019, which is in line with the global average increase in the first half 2021.

Figure 1 shows the development in median port stay in the USA. Here we can see a 20% increase in the median time spent in port. We looked at the data for European ports and saw very a large increase in median port stays for both Germany and France, whereas Netherland, United Kingdom and Belgium all saw a change more in line with the global average. Spain has even seen a marginal decline in median port stay time.