According to a recent study conducted by Sea-Intelligence, there is no evidence that nearshoring has grown since the COVID-19 pandemic.

Since the outbreak of the pandemic, there has been a great emphasis on the notion of nearshoring, in which manufacturing is brought closer to customers, in order to counteract the high tendency of production outsourcing witnessed in previous decades.

As a result of nearshoring, supply chains will be shorter as some production moves closer to the end-consumer, but not so close as to eliminate the need for container shipments entirely. This should result in a reduction in average sailing distances, reported Sea-Intelligence.

READ: Overcapacity absorption set to begin in 2028

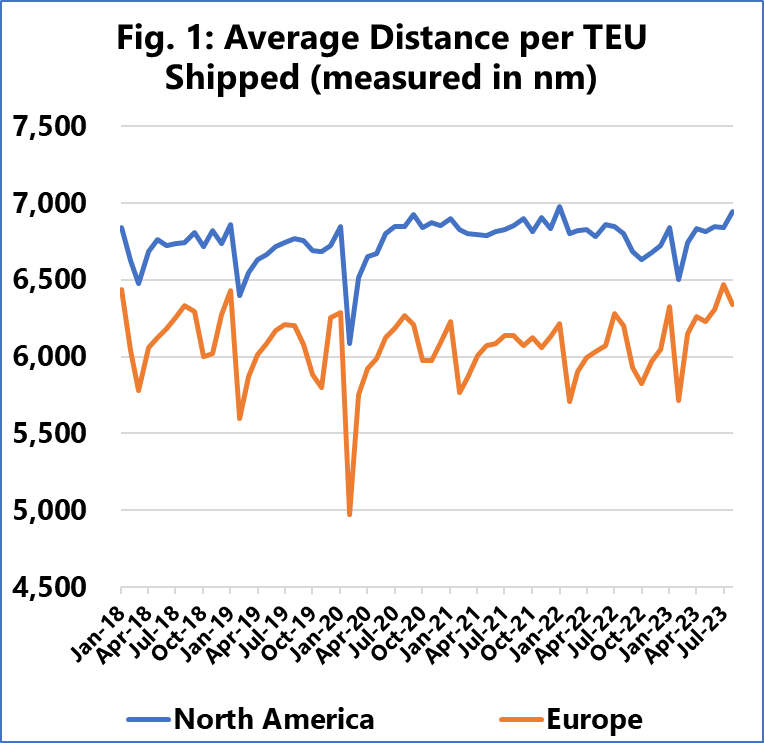

Figure 1 shows the average sailing distances of containers imported into North America and Europe. The large downward spikes are seasonally caused by Chinese New Year and Golden Week.

In North America, the sailing distance has risen compared to a pre-pandemic baseline, indicating that the concept of nearshoring is not supported.

Although there was a slight drop in imports into Europe early in the pandemic era, this has been reversed, and it would be more accurate to say that there has been a progressive rise in the sailing distance for goods going into Europe during the previous year, according to Sea-Intelligence.

READ: Vessel utilisation continues to decline

Furthermore, when analysing container trade volume data from Container Trade Statistics, Sea-Intelligence identified that intra-Europe container volumes, as a share of total European container imports, have been gradually declining since the height of the pandemic.

While container vessels transport just a small portion of intra-North American cargo, intra-North American container volumes have nearly halved as a fraction of total North American container imports during the pre-pandemic period, falling from an average of 1.2 per cent in 2019 to 0.6 per cent in 2023 year-to-date (YTD).

To summarise, the existing container volume trade data does not support the idea of increased nearshoring.