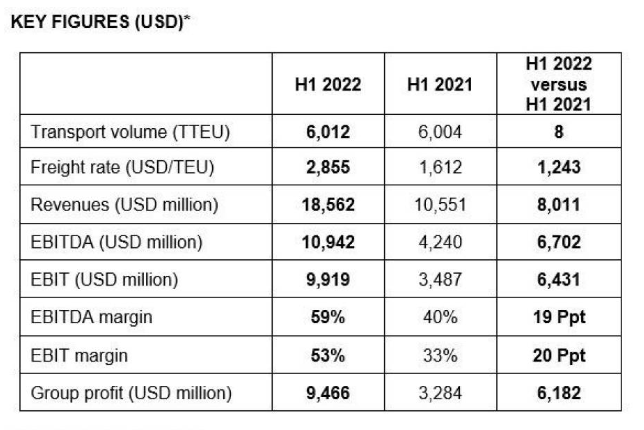

Hapag-Lloyd has concluded the first half of 2022 with an EBITDA of $10.9 billion, as it predicts strong results for the rest of the year amid uncertainties.

The EBIT rose to $9.9 billion, and the group profit climbed to $9.5 billion.

Revenues increased in the first half year of 2022 to $18.6 billion. This can mainly be attributed to a much higher average freight rate of $2,855 per TEU and a stronger US dollar, according to the company.

The results are in line with its forecast released only a few weeks ago.

“We have benefitted from significantly improved freight rates and look back on an extraordinarily strong business performance on the whole in the first half year,” said Rolf Habben Jansen, CEO of Hapag-Lloyd.

“At the same time, a steep rise in all cost categories is putting increased pressure on our unit costs.”

In the container sector, global supply chains hurdles have put great pressure on the segment as bottlenecks in ports and congested hinterland infrastructures marked this first half of the year.

READ: Supply chain rattles amid improved seaside congestion

Overall, the company’s transport volumes in this period were on a par with the prior-year level, at approximately 6 million TEU.

Hapag-Lloyd said the result was impacted by significantly higher expenses for container handling and charter ships as well as by a 67 per cent increase in the average bunker consumption price.

Based on the current performance, the company anticipates a strong second half of the year, with a forecasted EBITDA in the range of $19.5 to $21.5 billion and an EBIT in the range of $17.5 to $19.5 billion.

Hapag-Lloyd has acknowledged that the Russia-Ukraine war, ongoing disruptions in supply chains, and impacts of the COVID-19 pandemic may still cause issues across its business – although first signs suggest spot rates are easing in the market.

READ: ‘Swift normalisation’ not on the cards for container market

Last week, Hapag-Lloyd announced the installation of live trackers on all its containers at the end of this month.