According to Sea-Intelligence’s most recent estimate, consumers in the US are still spending more than before the pandemic, despite growth having fallen to a little less than 5 per cent.

Spending growth on non-durable products has virtually remained since 2021, with a slight increase in February 2024, whilst actual spending growth has been mostly for durable goods.

READ: Shipping carriers lose $1.44 billion EBIT in Q4 2023

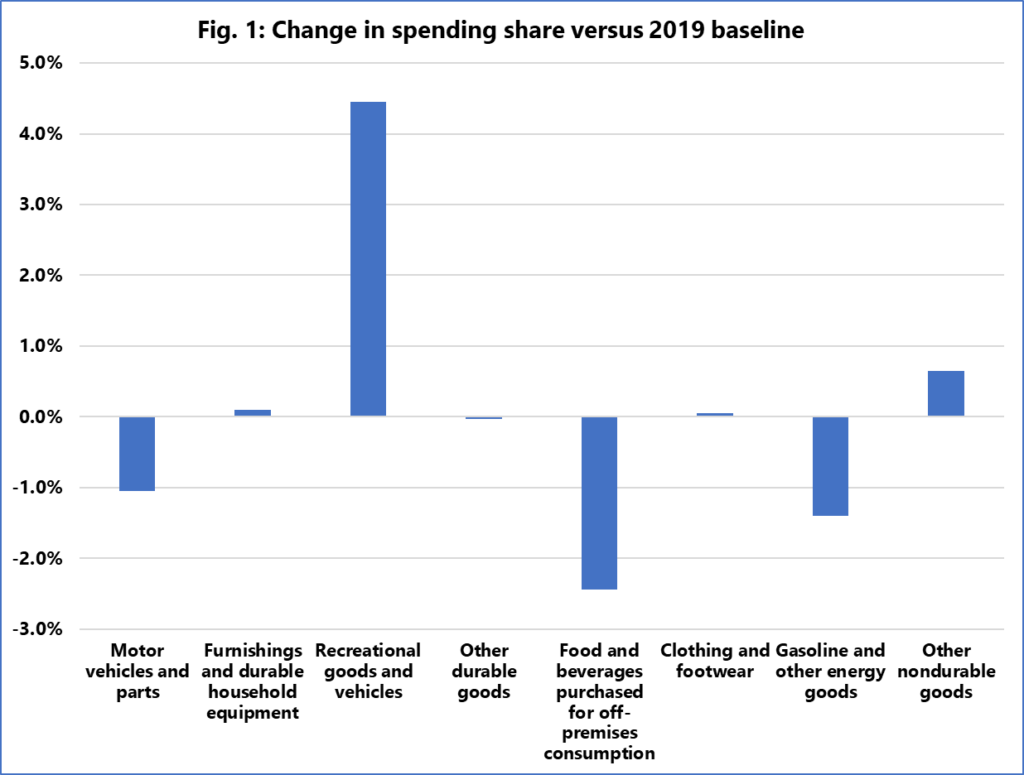

To illustrate, Sea-Intelligence estimated the difference in the average proportion of total goods spending for each major sub-category between 2019-FY and February 2024, as shown in Figure 1.

The proportional importance of leisure items and automobiles is increasing significantly. In 2019, the typical US consumer spent 10.2 per cent of their expenditure on leisure items and cars. In February 2024, this had risen to 14.7 per cent.

READ: Hapag-Lloyd crowned most reliable carrier in February

Alan Murphy, CEO of Sea-Intelligence, said: “While this appears to be excellent news for container shipping, when we dig further we discover that the items seeing high growth are ones that have not historically been handled in containers.

“This is important because, while growth in overall spending on goods in the US is in general still holding up at levels higher than prior to the pandemic, it is now often in categories where the goods in question are not traditionally moving in containers.

“This presents the shipping lines with the challenge that the growth in the economy does not lead to the expected growth in container volumes that they would usually assume.”

This month, Sea-Intelligence reported spot rates have consistently declined over several months.