Sea-Intelligence has assessed the possible effect in of the Red Sea crisis in 2024 after reworking liner networks to employ round-of-Africa routing.

By using its regular technique for estimating demand in TEU Miles, Sea-Intelligence reported 860 billion worldwide TEU Miles in 2023.

Since the analysis firm is attempting to assess the impact of the Red Sea crisis on a normal scenario, carrying the same amount of cargo globally in 2024, but with a diversion around COGH, would result in a requirement of 994 billion TEU Miles. This is a 16 per cent gain.

READ: Marginal capacity change amid Red Sea crisis

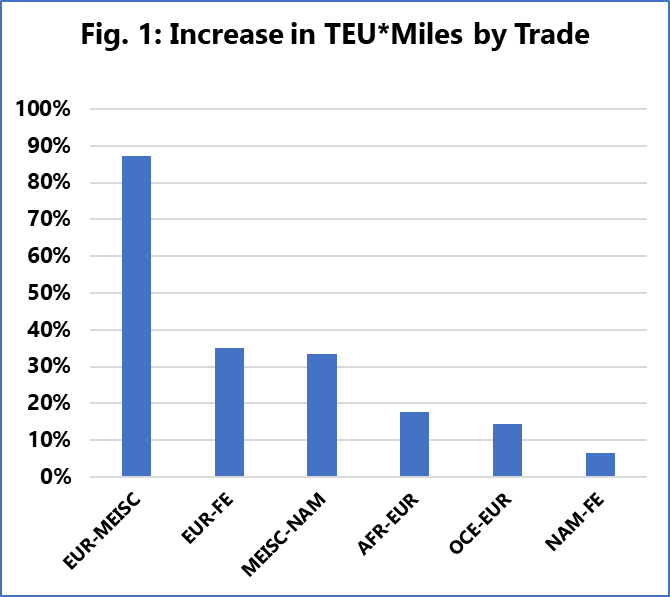

As shown in Figure 1, the Europe-Indian Subcontinent trade is by far the most impacted.

The trade between the Far East and North America is the least damaged overall, but this is because the impact is volume-weighted, and the distances from the Far East to the US West Coast are unaffected, as is the distance from the Far East to the US East Coast via Panama.

The 16 per cent increase in global TEU Miles in turn means that the need for capacity also increases by 16 per cent.

READ: Sharp surge in shipping emissions predicted amid Red Sea crisis

Alan Murphy, CEO of Sea-Intelligence, said: “This can be accommodated by the carriers through 2 mechanisms.

“The first is by absorbing the current significant overcapacity, which will become worse as more capacity is delivered during 2024. The second is by speeding up vessels to allow the same amount of vessel capacity to deliver more TEU Miles per year.

“At present, both mechanisms are at play. It should be expected that during 2024, the continued injection of more capacity will likely be used to slow the existing vessels down somewhat.”