Sea-Intelligence has used its Trade Capacity Outlook database to compare the capacity available before and throughout the Red Sea crisis.

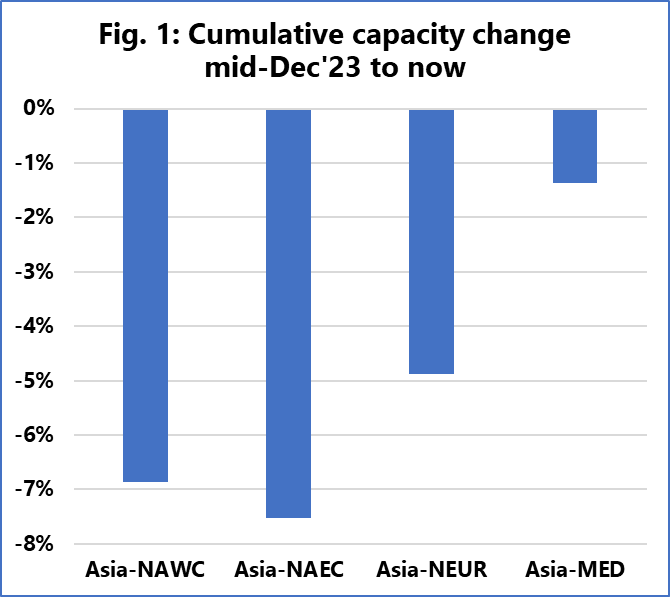

The figure below depicts the cumulative change in offered capacity for each of the four major East/West transactions originating in Asia from mid-December to the present.

Sea-Intelligence noted that it purposefully did not mention future capacity since it would interfere with Chinese New Year impacts.

The cumulative changes up to the present day would therefore more ‘cleanly’ portray the Red Sea impact.

READ: Red Sea crisis causes short-term capacity impact

The Transpacific commerce has had the greatest capacity reduction compared to planned deployment in mid-December, with the Asia-North America East Coast trade lane down 7.5 per cent and the Asia-North America West Coast trade lane down 6.9 per cent.

In contrast, the capacity impact on the Asia-North Europe trade lane has been a contraction of 4.9 per cent, while the capacity impact on the Asia-Mediterranean trade lane has been just 1.4 per cent.

Alan Murphy, CEO of Sea-Intelligence, said: “What this shows is that despite the extreme upheaval in the vessel schedules, the capacity offered from Asia to Europe has only been reduced quite marginally because of the Red Sea crisis.

“The capacity reduction here measured is not measured year-over-year (YoY), but of the planned schedules in mid-December versus what has materialised until now. Curiously, as shown in Figure 1, the impact on the Transpacific is larger, and it is particularly interesting to see the capacity drawdown on Asia-North America West Coast.”

In January 2024, Drewry predicted that the damage caused by the Red Sea crisis will be less severe in the long term compared to the impact of the COVID-19 pandemic.