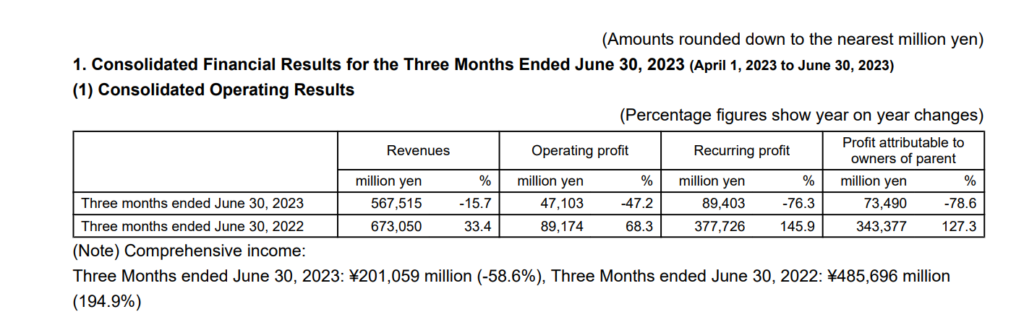

NYK Line has released its financial statistics for the second quarter of this year, revealing a 58 per cent decline in comprehensive income in June 2023 compared to the same period last year.

The statistics indicate a decline in comprehensive income in June 2023, with ¥201 million ($1.4 million) down -58.6 per cent compared to the three months ending 30 June 2022, ¥485.6 million ($3.4 million).

The shipping company has designated the stable return of profits to shareholders as one of the most important management priorities.

The target consolidated payout ratio has been set based on management goals and the shareholder return strategy in the medium-term management plan that began this year (fiscal year ending March 31, 2024).

READ: ONE boosts NYK, K Line, MOL earnings outlooks

According to the shipping company, the minimum annual dividend per share has been fixed at 100, while the maximum annual payout has been raised to 30 per cent.

It is now intended to distribute an interim dividend for the current fiscal year under this policy of ¥60 ($0.42).

More recently, Freesia Leader, the fifth LNG-fueled pure car and truck carrier (PCTC) operated by NYK, arrived at the Port of Nagoya in Aichi Prefecture.