Data from Sea-Intelligence indicates that container markets are currently operating at a 5.9 per cent loss when compared to the anticipated growth based on global GDP.

Global container demand traditionally had a close association with global GDP growth, but in the years leading up to the pandemic, this correlation began to weaken as per Sea-Intelligence’s latest analysis.

Pre-pandemic, there was a noticeable shift away from the historical pattern of container demand growing at a multiplier above GDP growth.

“Knowing the actual TEU growth versus 2019, this in turn allows us to calculate how much global TEU grow in excess of what the global GDP would otherwise indicate,” explained Alan Murphy, CEO of Sea-Intelligence.

“What we see is that compared to the growth rate one would expect based on global GDP, the container markets are 5.9 per cent below.”

READ: Stabilised container demand averts June collapse

While TEU serve as a coarse measure of global demand, a more comprehensive picture emerges when considering TEU*Miles within the context of global container vessel fleet capacity.

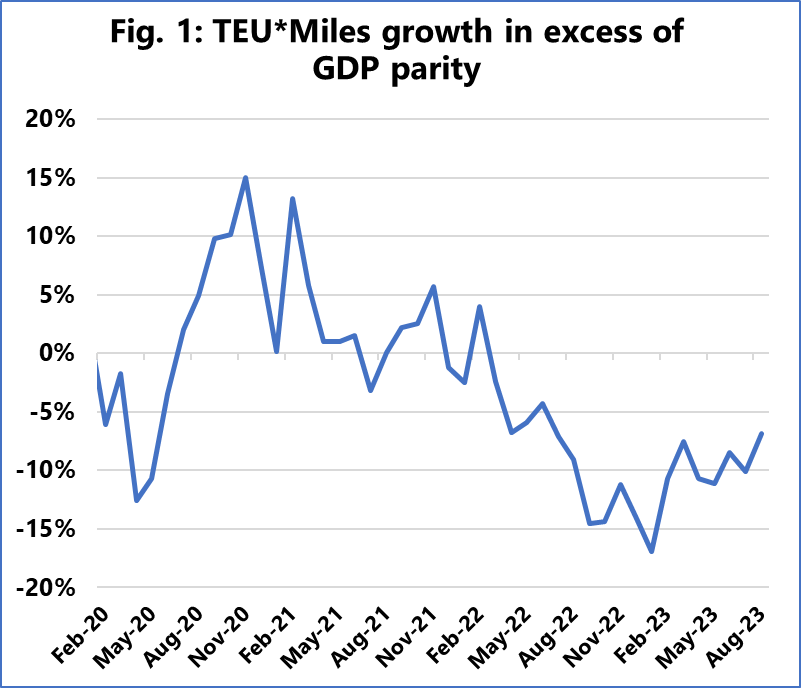

In Figure 1, Sea-intelligence has calculated the disparity between the growth rate implied by GDP and the actual growth rate of TEU*Miles.

“As of August 2023, global demand has a shortfall of 6.8 per cent compared to a growth pattern which would have followed global GDP growth,” said Murphy.

“This is not good for the carriers, which are in the process of taking delivery of a sizeable orderbook.”