Container xChange has released its latest China market update, shedding light on the current container price trends in China.

Despite expectations of price drops post-Chinese New Year, the market is witnessing a significant mismatch between buyer and seller price expectations, in a demand deficit environment.

China’s exports to Russia grew by 12.5 per cent year on year in the first two months of 2024, while imports rose by 6.7 per cent.

Data from Container xChange’s market intelligence team reveals that while there is a surplus of units held up in Russia, capacity in that region remains saturated.

This situation has not created enough confidence for significant price drops and has resulted in a cautious approach from both buyers and sellers, leading to a gradual filling up of depots.

However, the current depot pressure is not yet strong enough to prompt traders and sellers to lower their price expectations, nor is there significant pressure from buyers to increase their price expectations, according to Container xChange.

“There is a significant imbalance between supply and demand price expectations for containers,” said Christian Roeloffs, Co-founder and CEO of Container xChange.

“Buyers are expecting price reductions in weeks to come, while sellers are holding off the inventory as they expect prices to remain stable due to tight capacity, especially after the diversions due to the Red Sea and highly imbalanced trade, particularly, for example from China into Russia.”

“Looking ahead, while mid to long-term forecasts suggest a necessary adjustment in prices to restore liquidity, the present market sentiment indicates a reluctance to anticipate significant price drops,” Reoloffs continued.

READ: China’s current footing in global shipping

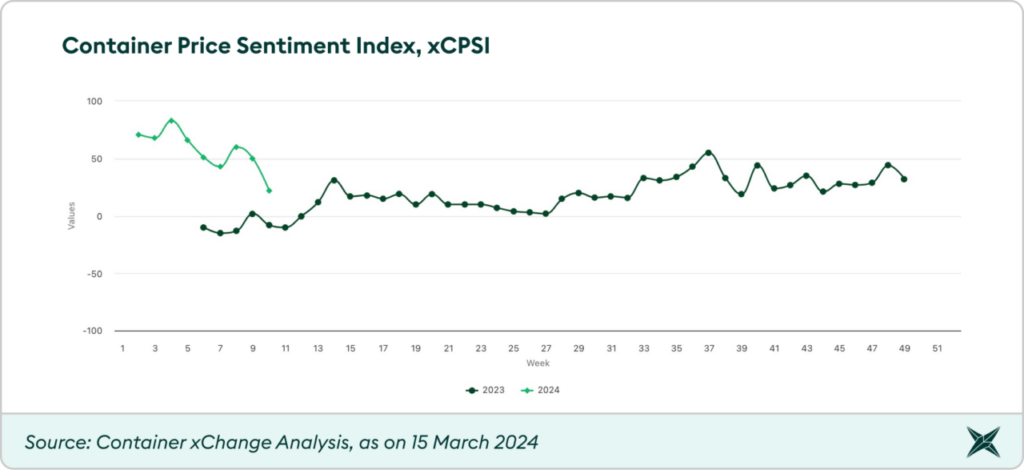

The buyer sentiment of further price declines is also echoed by the Container Price Sentiment Index (xCPSI), a proprietary market sentiment tool for container prices by Container xChange, where the index value fell from an all-time high of 83 points in the last week of January this year, to 22 points as on 14 March 2024.

The recent decrease in freight rates, from $3,351 on 23 February 2024 to $3,069 on 8 March 2024, represents an approximate 8.41 per cent decline. This trend indicates a more balanced market and aligns with Container xChange’s observation that container prices are not showing significant increases in March.

READ: Italy to exit China’s Belt and Road Initiative

As Container xChange pointed out, the decline in freight rates and the steady container prices suggest that demand is under pressure. Additionally, the management of the Red Sea crisis has alleviated concerns of sudden container price rises, providing a more predictable environment for freight forwarders and stakeholders.”

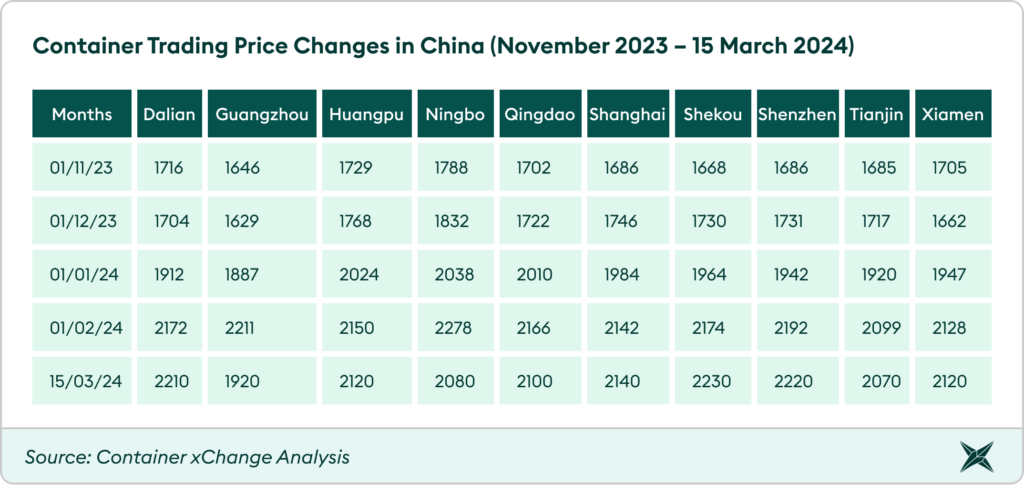

The analysis of container trading price data from November 2023 to March 2024 reveals a cyclical upsurge in prices leading up to the Lunar New Year, followed by a stabilisation in prices post the holiday period. Cities such as Dalian, Fuzhou, Guangzhou, Shanghai, and Qingdao have shown significant percentage increases in prices, aligning with the cyclical trend.

The average price for 40-foot cargo-worthy containers in China was around $1,700 in November 2023, while this has stayed at elevated levels since the Houthi attacks at $2,100 so far in March 2024.

Moreover last month, the latest BIMCO market report showed a sluggish growth of just 0.2 per cent in the container market compared to last year, reaching a total of 173.8 million TEU.