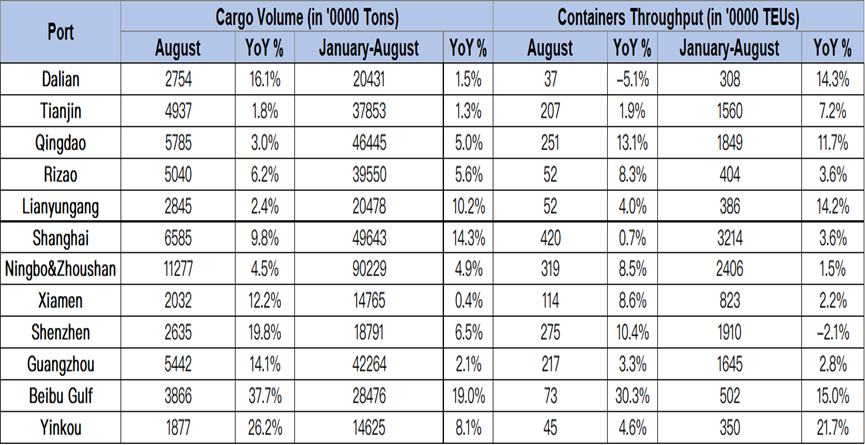

The container throughput of Chinese ports from January to August of 2023 hit 203.7 million TEU, a year-on-year (YoY) increase of 4.8 per cent.

Meanwhile, the cargo volume of Chinese ports was 1.11 million tonnes a YoY increase of 8.4 per cent.

The chart below shows the cargo throughput and container throughput data of the 12 major ports in China.

READ: China ports container volume hits 176 million TEU

The Port of Shanghai, which secured its spot as the world’s busiest port with 43.19 million TEU moved in 2022, witnessed an increase in container volumes of 3.6 per cent YoY from January to August of this year totalling 32.14 million TEU.

The Port of Ningbo-Zhoushan also demonstrated praiseworthy performance by handling a total of 24 million TEU in the first half of the year.

As of the first eight months of 2023, the Port of Qingdao, ranking as the third-best performing port in China, achieved a remarkable 11.7 per cent growth, handling a total of 18.49 million TEU.

READ: Top 10 Ports in China 2022

In terms of container freight rates, the average value of the Ningbo Container Freight index (NCFI) in September was quotes 661.7 points, an increase of 10.6 per cent compare to last month.

In September, the transportation demand from Ningbo to the North American market is weak, but the vessel capacity of box liners is sufficient, and the decline in freight rates has further expanded.

With the arrival of China’s National Day holiday, the volume of export cargo has further decreased.

The average freight rate of 40GP from Ningbo Port to the Port of Los Angeles port and the Port of New York & New Jersey in August was $2626 (-2.6 per cent) and $1960 (-15.2 per cent) month-on-month respectively.