According to Sea-Intelligence, vessel utilisation is continuing to fall as the year comes to a close.

When combined with container demand data, blank sailings data may be used to calculate the underlying capacity utilisation on the key East/West trades.

The issue with this simplified method is that it is not always the “true” capacity utilisation, since vessels from Asia to Europe may also be carrying capacity/cargo designated to other trades, such as Asia to West Africa or Asia to the Middle East.

However, given that the same limitations apply throughout, relative changes in time would be representative.

READ: Schedule reliability remains within a restricted range

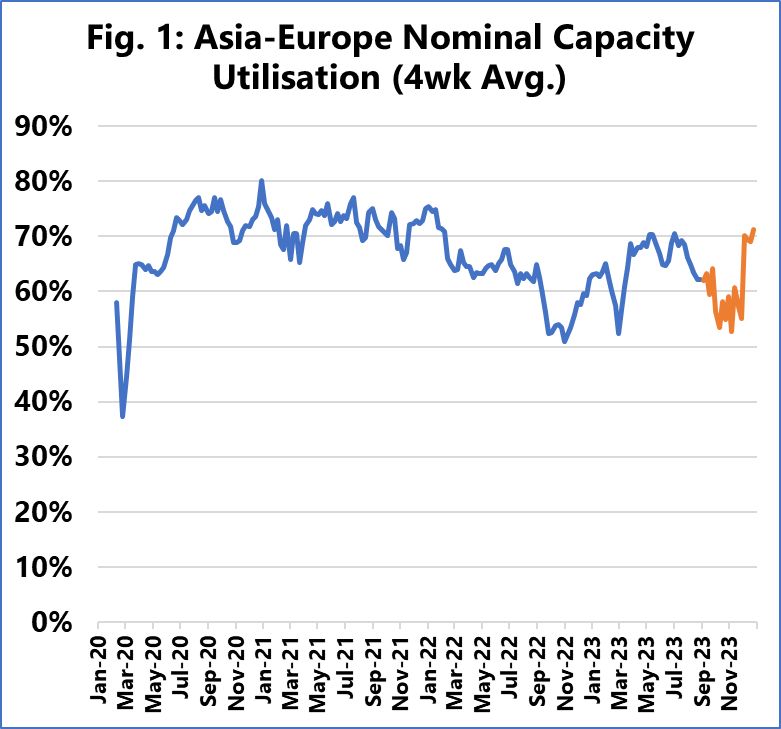

Figure 1 depicts the underlying capacity usage revealed by Sea-Intelligence, with the blue line representing current utilisation and the orange line representing our prediction for the remainder of 2023.

The supply forecast is based on carrier vessel deployment plans until 2023. For the demand prediction, Sea-Intelligence used the demand rise from June to August 2023 (relative to the pre-pandemic period of 2019) and projected the same pattern for the rest of 2023.

Alan Murphy, CEO of Sea-Intelligence, said: “As we can see, usage has been quite low in recent months. Carriers have announced a slew of blank sailings in recent weeks.

“Even then, there has been significant year-on-year (YoY) growth in the capacity being offered in the market. If the intention of these blank sailings was to revert capacity growth, that hasn’t happened. As a result, we will continue to see very low utilisation in November 2023.”

READ: Carriers’ profits not a major driver of inflation

The rapid rise in usage in December 2023 is very doubtful. The reason for this increase is due to demand changes noticed in December 2019 before to the pandemic.

There was a significant demand rise at the time, which is driving the expected spike in December 2023 seen in Figure 1. As a result, Sea-Intelligence believes that improved vessel utilisation in December is unlikely.

Last month, Sea-Intelligence reported the earliest recovery to the supply/demand equilibrium will begin in 2028.