Sea-Intelligence has reported a 4 – 5 per cent year-over-year (YoY) drop in Transpacific capacity for April–May, reversing earlier growth plans amid changing market conditions.

For April and May combined, 19 per cent of planned Asia–NAWC and 17 per cent of Asia–NAEC capacity has been blanked.

However, Sea-Intelligence noted that elevated levels of blank sailings do not indicate a substantial YoY capacity decline if the initially planned capacity was already significantly higher than the previous year.

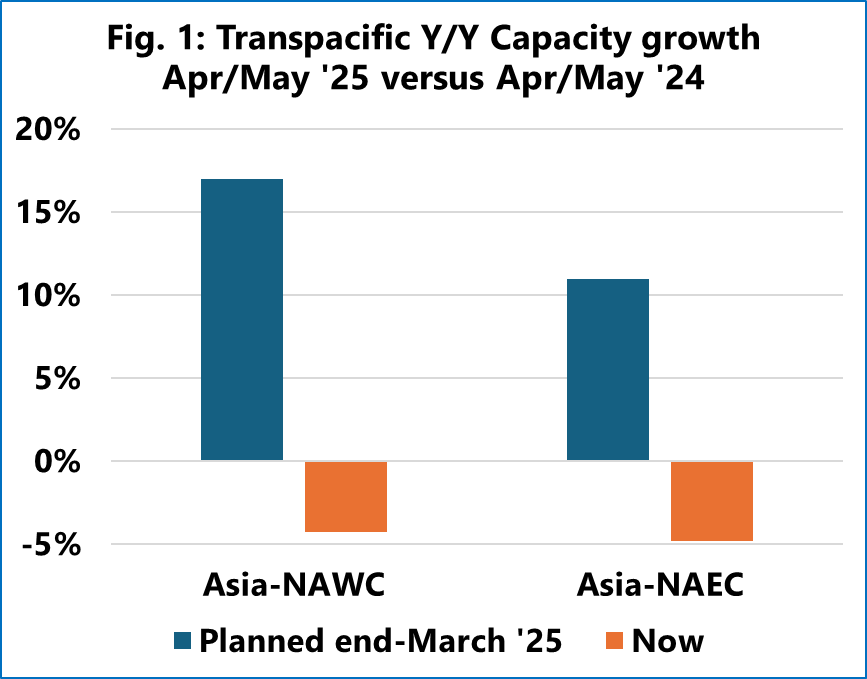

At the end of March, carriers planned to increase Asia–NAWC capacity by 17.0 per cent YoY, but this has shifted to a 4.3 per cent YoY decline for April – May.

Similarly, Asia – NAEC capacity was set to rise 10.9 per cent YoY, but is now down 4.9 per cent YoY.

READ: Trump’s tariffs drive surge in Transpacific blank sailings

Alan Murphy, CEO of Sea-Intelligence, said: “This explains the seemingly counterintuitive situation, where blanked capacity is 17 per cent – 19 per cent of the total planned capacity on the two Transpacific trade lanes, while YoY capacity reduction is ‘only’ 4 per cent – 5 per cent.”

The Danish analytics firm reports that although shipping lines had planned a substantial capacity increase as of late March, the implementation of widespread blank sailings and the deployment of smaller vessels have reversed this, resulting in a YoY capacity decline.

Murphy added: “While the Chinese volume drop will be partially offset by uptake elsewhere in Asia, it does not seem likely that gains in the rest of Asia can offset the loss from China. This could result in even more blank sailings in the coming weeks, and possible lead to a significant drop in spot rates.”