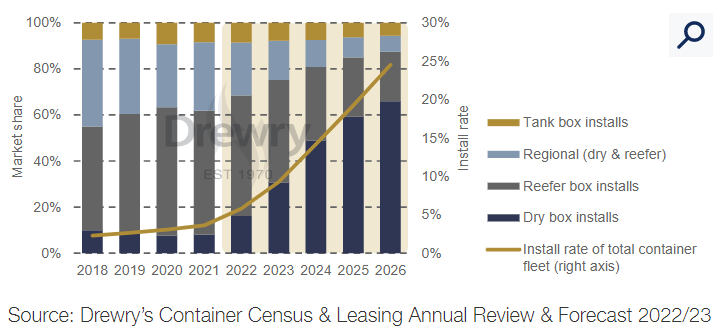

The global smart container equipment fleet is forecast to grow eight-fold over the next five years and account for 25 per cent of global box inventories by 2026, according to Drewry analysis.

Drewry estimates that by the end of 2021 around 3.6 per cent of the global container equipment fleet was fitted with smart technology devices following growth of over 30 per cent through the year.

However, take-up varies considerably by equipment type – with penetration already strong in reefer and intermodal containers such as those used by HMM – but much lower in the dry box sector.

Already as much as a third of the maritime reefer container fleet is smart-enabled, while the figure is over 40 per cent for intermodal containers, according to Drewry estimates.

Smart containers have increased in prominence following the onset of the COVID-19 pandemic and resultant supply chain disruption which has highlighted the need for better cargo visibility to cope with longer and more volatile transit times.

A container becomes ‘smart’ when fitted with a telematics device that provides real-time tracking and monitoring, enabling operators to increase turn time of their containers and so improve equipment availability.

It also allows beneficial cargo owners (BCOs) to understand the location and status of their cargo so that they can better control their supply chains.

Drewry forecasts that the number of smart containers in the global fleet will accelerate in the five years to 2026 to reach over 8.7 million units, representing as much as 25 prer cent of worldwide box inventories. As technological innovation lowers the cost of devices and enhances their value to both transport operators and BCOs, uptake is expected to hasten.

Smart fleet acceleration will now be driven by strong uptake in the dry container fleet where penetration is currently as little as 0.3 per cent, according to Drewry estimates.

Shipping line return on investment will come from the potential to optimise their box fleet and cargo operations. Furthermore, digitising their container fleets will enable carriers to better control maritime supply chain information flows, enhancing their cargo visibility offering and so tethering BCO clients into longer term contractual commitments.

To achieve this step change, Drewry continues, further investment will be needed to integrate smart containers into carrier IoT systems and collaboration among industry stakeholders to enable data sharing, particularly between carrier alliance and supply chain partners.