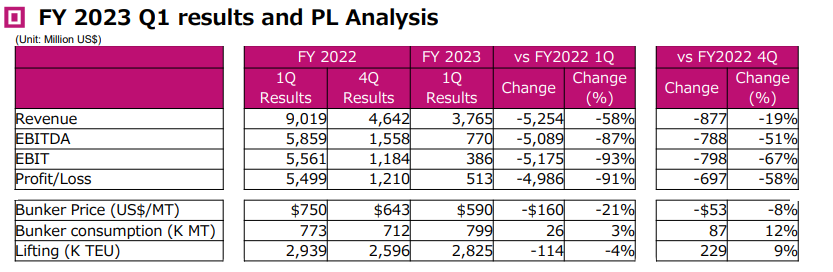

Ocean Network Express Ltd. (ONE) has revealed its financial results for the first quarter of this year, posting an 58 per cent drop in revenue to $3.76 billion.

The figure came amid a 4 per cent drop in liftings to 2.82 million TEU, which, according to container shipping specialist Lars Jensen, equals to a 57 per cent drop from the same quarter last year.

ONE also disclosed data indicating an 87 per cent dip in EBITDA from Q1 FY22 to Q1 FY23.

Furthermore, the shipping firm supplied statistics indicating a year-on-year 93 per cent decline in EBIT in the first quarter of 2023.

According to ONE’s financial report, its net profit fell 91 per cent to $513 million as “the supply and demand balance in the East-West trades has not recovered, resulting in a gradual downward trend for short-term freight rate levels.”

In comparison to Q4 2022, North America eastward liftings increased due to relieved port congestion, but utilisation rates declined due to greater vessel turnover.

Westbound trade volumes between Asia and Europe grew (mostly to the Mediterranean), but vessel utilisation remained steady.

READ: ONE set to host second Container Shipping Summit

Liftings in Asia-North America stayed identical to the same time last year, whereas liftings in Asia-Europe decreased.

According to ONE, the worldwide supply chain has been affected as a result of the COVID-19 pandemic, as well as changes in consumer behaviour and trade patterns as a result of escalating geopolitical tensions.

ONE stated that “it is making progress in adapting to these major changes, but further shifts in the market are expected as transport demand and trade patterns continue to alter, creating an uncertain outlook which is difficult to predict.”

Earlier in June, ONE Innovation, the first of six long-term contracted 24,000 TEU vessels from Shoei Kisen Kaisha, was delivered and deployed on Asia-Europe trade.