The Baltic and International Maritime Council (BIMCO) has recorded a new containership delivered in the first seven months of the year set a new high of 1.2 million TEU in 2023, exceeding the previous record by 0.2 million TEU.

Although ship recycling has remained modest, fleet capacity has increased by 4.3 per cent since January. Contracting for new ships has dropped since its peak in 2021, but it is still twice as high as it was in the 2010s.

The 1.3 million TEU contracted thus far this year has kept the order book high, falling only 3,000 TEU shy of the record 7.6 million TEU established in March 2023.

In fact, the order book is so enormous that ship deliveries are likely to surpass the previous full-year record of 1.7 million TEU for the third year in a running.

Based on current estimated delivery dates, a total of 2.4, 2.9, and 1.9 million TEU are expected to be delivered in 2023, 2024 and 2025 respectively.

Ship recycling is also projected to rise in the future years. As owners strive to cut greenhouse gas emissions, more energy efficient ships will replace less efficient ones.

Despite the recycling of older ships, the fleet is forecast to expand by 4.5 million TEU between early 2023 and early 2025, boosting fleet capacity by about 18 per cent.

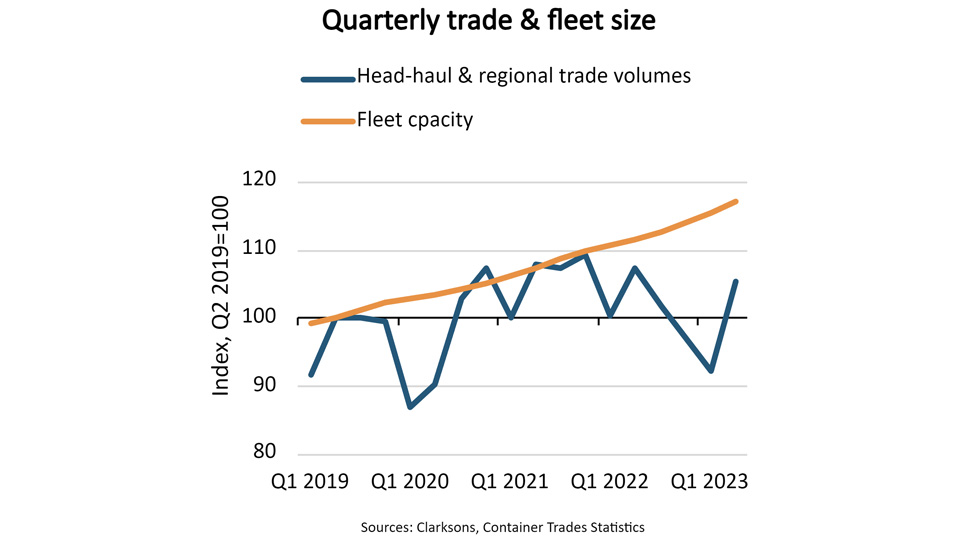

The expansion in fleet capacity comes at a time when current trade growth in many important countries is slowing and global economic growth prospects for the next few years are deteriorating.

According to Container Trades Statistics (CTS), overall global container volumes declined 4.3 per cent year on year (YoY) in the first half of 2023 and concluded just 0.2 per cent higher than in the first half of 2019.

READ: BIMCO publishes latest eBL standard

The crucial head-haul and regional trade routes declined 4.9 percent YoY but remained 3.1 per cent higher than in the first half of 2019.

Fortunately, the head-haul and regional trade lanes improved in the second quarter, with volumes falling 2 per cent YoY but remaining 5.3 per cent larger than in 2019.

Niels Rasmussen, Chief Shipping Analyst at BIMCO, stated: “Highlighting the current time charter and freight rate market weakness, head-haul and regional trade volumes have grown 5.3 per cent compared to Q2 2019 while fleet capacity has grown 17 per cent.

“Future supply growth may be tempered by reduced sailing speeds but further fleet capacity growth of about 15 per cent in the coming year and a half underlines how supply side growth will remain a challenge for ship owners and operators.”