Carriers could look increase laden exports out of the North America West Coast (NAWC) as import growth to the coast has begun to slow down.

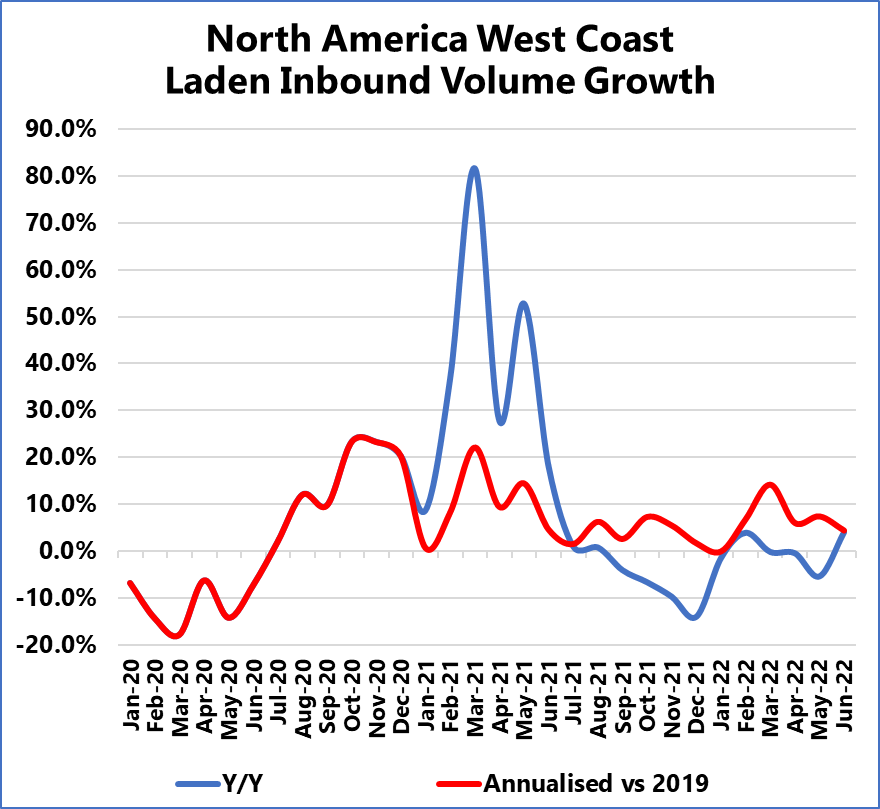

According to latest findings from Sea-Intelligence, in 2022 on a year-on-year basis the growth of loaded import containers has been negative in four out of the first six months of 2022, when compared to pre-pandemic annualised 2019 figures.

When compared to 2019, there has been continued growth since July 2020 – however the growth has slowed from the highs of 20 per cent in 2020-2H, to mostly in the 0-5 per cent range through second-half 2021.

In 2022, the year-on-year change has been negative in 4 out of the 6 months, although the June 2022 growth was 4 per cent.

On an annualised basis however, which takes into account erratic cargo flows due to the pandemic, the growth rate has largely been under 6 per cent since the second half of 2021.

READ: Port of Long Beach boasts best July on record

Annualised growth rate has slightly level-shifted upwards slightly to 4 per cent to 8 per cent from February 2022, although the overall trend in 2022-Q2 has been downwards.

Whilst carriers are continuing to prioritise empty export containers out of NAWC, carriers “might be looking at a lower utilisation on the head-haul, and we might start to see an increase in laden exports out of North America West Coast,” Murphy wrote.

The laden to empty container export ratio, which is at 0.5 right now (favouring empty exports), should then start to increase, Murphy added.

In June two Californian Congressmen introduced legislation to benefit US exporters following unprecedented supply chain disruption across the nation.

Sea-Intelligence analysed the container handling statistics for the major North America West Coast ports (Los Angeles/Long Beach, Oakland, Prince Rupert, Vancouver, and Seattle/Tacoma).