The 2022 global container port throughput saw a marginal increase of less than 1 per cent, reaching 454 million TEU, primarily driven by China and the Middle East.

Although the figure is a record high, the growth rate was lower than the previous year according to the latest analysis from Alphaliner.

China’s top 10 ports experienced a 4.1 per cent increase to reach 222 million TEU, whilst the growth rate in 2021 reached 6.2 per cent.

Dubai’s throughput rose by 1.6 per cent to 13.9 million TEU, with Tangier Med’s volumes soaring 5.6 per cent to 7.6 million TEU – adding 423,000 TEU in volume.

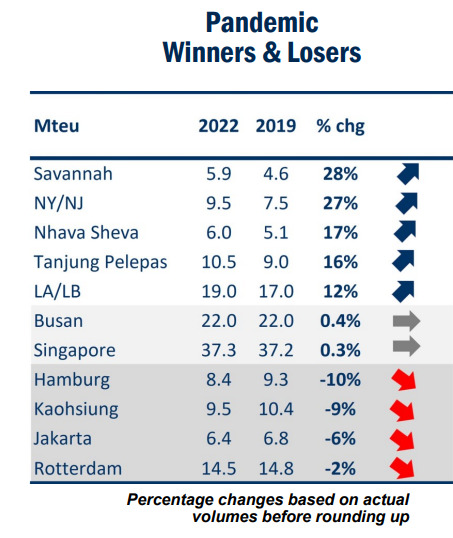

However, many European, Indian sub-continent, and Asian ports experienced declines – reported Alphaliner – with Port Kelang, Kaohsiung, and Jakarta falling below 2019 volumes.

The three main ports in Europe, namely Rotterdam, Antwerp-Bruges, and Hamburg, experienced a decrease in headline volumes by 5.8 per cent, 5.5 per cent, and 5.4 per cent, respectively.

The decline was especially harsh for Antwerp, which had merged with the coastal port of Zeebrugge in April 2022. Considering the estimated combined throughput of the two ports in 2021, the actual decline in 2022 is more likely to be around 6.5 per cent according to Alphaliner’s estimates.

As a result, the throughput for all three European ports is now below the 2019 levels.

READ: Port of Antwerp-Bruges Q1 throughput drops due to economic slowdown

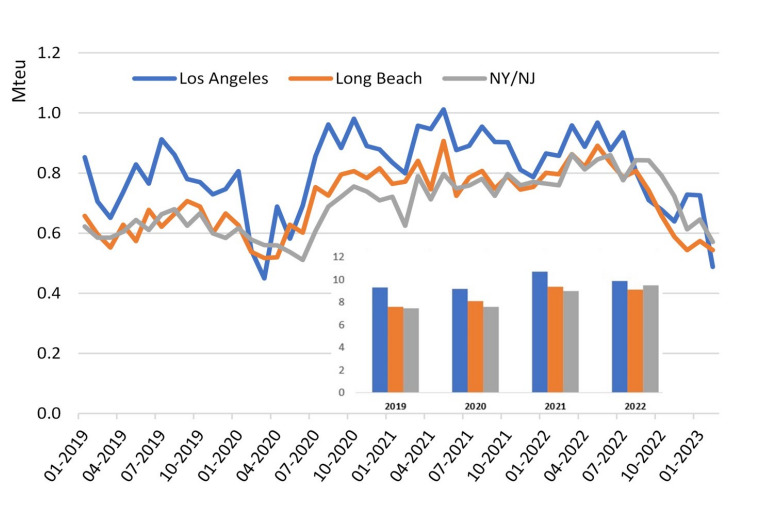

In the US, Alphaliner noted that the Port of New York and New Jersey rose to become the country’s busiest port, with a volume increase of 5.3 per cent, while Savannah grew by 4.7 per cent.

Los Angeles experienced a 5.3 per cent decline in throughput, falling to second place. Volumes for the four leading US container ports – NY/NJ, LA, Long Beach, and Savannah – are now well above 2019 levels.

READ: Long Beach imports take a hit as eastward shift drags on

Without the growth at China’s major ports, the remaining top 30 ports would have experienced a 2 per cent decline in volumes according to Alphaliner.