The global decline in container demand experienced a notable recovery in March 2023 across the majority of trade lanes, with the exception of US imports from Asia.

According to the most recent analysis from Sea-Intelligence, US imports from Asia have been consistently declining at a fluctuating rate of around -20 per cent year-on-year.

This decline has often been attributed to US inventory correction. However, data from the US Census Bureau reveals that the process of clearing inventories is not progressing rapidly, raising questions about the underlying factors.

READ: US import cargo rebounds but falls short of 2022 levels

Inflation plays a significant role in both sales and inventories, but the inventory-to-sales ratio remains unaffected by inflation. Sea-Intelligence indicates that while manufacturers’ inventories have stagnated and not decreased significantly, retailers and wholesalers are witnessing an increasing trend.

This suggests that inventories are growing relative to sales, and any ongoing inventory correction appears to be inadequate.

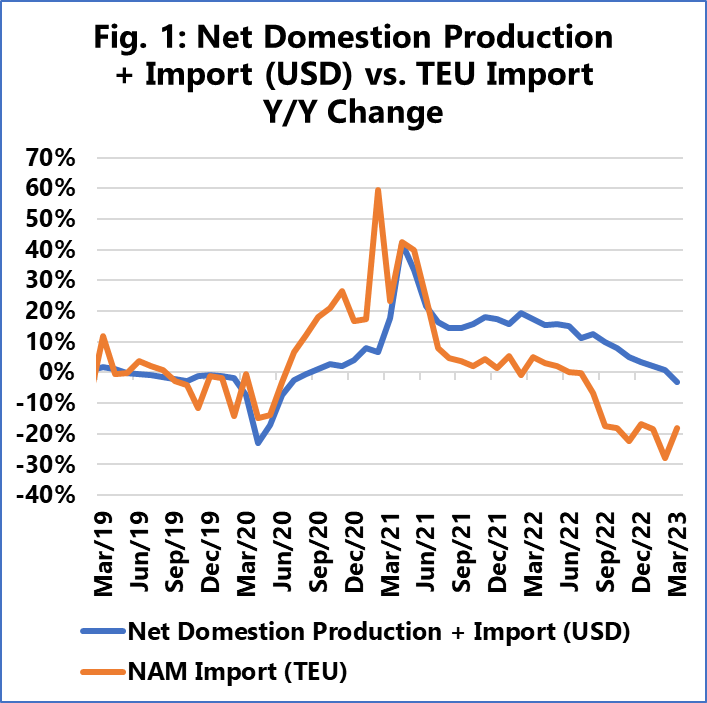

Sea-Intelligence notes that by combining monthly total sales ad monthly net change in total inventories, this should equate to the value of imports plus domestic production.

Assuming domestic production remains relatively stable, albeit a small share, a strong correlation with volume imports is expected.

READ: North America West Coast ports show signs of import normalisation

The above graph illustrates a clear pre-pandemic correlation, with USD imports lagging behind during the pandemic. However, the sharp decline in TEU imports does not proportionally reflect the drop in the value of imports, according to Sea-Intelligence.

“Part of the disconnect might simply be owing to the contraction of the supply chain, however the supply chain is now rapidly approaching normalisation,” said Alan Murphy, CEO, Sea-Intelligence.

“One alternative explanation might very well be a normalisation of consumer spending habits.”

The surge in US imports from 2020 to 2021 was partially driven by a shift in consumer spending from services to goods, resulting in increased container volumes.

As pointed out in Sea-Intelligence’s analysis, reversing this spending behaviour is expected to negatively impact container volumes for an extended period, potentially affecting the upcoming peak season in 2023.

In the context of the US market, Sea-Intelligence recently noted that North American ports experienced a more significant impact during the pandemic compared to the global average in terms of the time vessels spend at the port.

This has resulted in a severe decrease in the effective capacity of terminals to handle vessels.